The leveraged portfolio return for Aschel is closest to: A. 7.25%. B. 7.71%. C. 8.96%. Ccile is

Question:

The leveraged portfolio return for Aschel is closest to:

A. 7.25%.

B. 7.71%.

C. 8.96%.

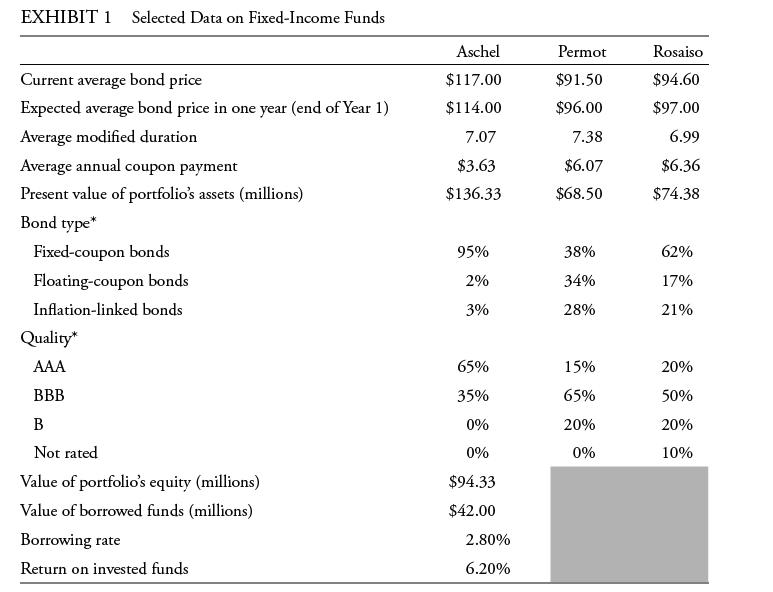

Cécile is a junior analyst for an international wealth management firm. Her supervisor, Margit, asks Cécile to evaluate three fixed-income funds as part of the firm’s global fixed-income offerings. Selected financial data for the funds Aschel, Permot, and Rosaiso are presented in Exhibit 1. In Cécile’s initial review, she assumes that there is no reinvestment income and that the yield curve remains unchanged.

After further review of the composition of each of the funds, Cécile makes the following notes:

Note 1: Aschel is the only fund of the three that uses leverage.

Note 2: Rosaiso is the only fund of the three that holds a significant number of bonds with embedded options.

Margit asks Cécile to analyze liability-based mandates for a meeting with Villash Foundation. Villash Foundation is a tax-exempt client. Prior to the meeting, Cécile identifies what she considers to be two key features of a liability-based mandate.

Feature 1 It can minimize the risk of deficient cash inflows for a company.

Feature 2 It matches expected liability payments with future projected cash inflows.

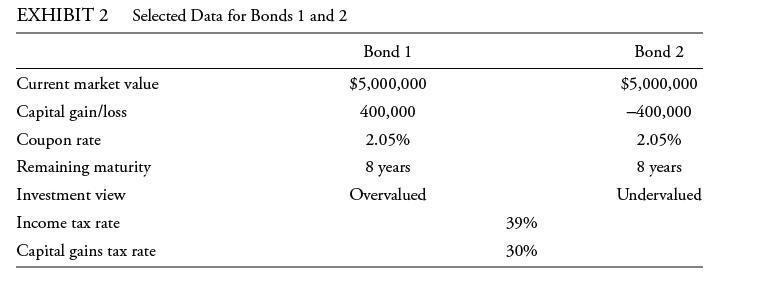

Two years later, Margit learns that Villash Foundation needs $5 million in cash to meet liabilities. She asks Cécile to analyze two bonds for possible liquidation. Selected data on the two bonds are presented in Exhibit 2.

Step by Step Answer: