Consider the investor from the prior example who sought to underweight a French media and telecommunications issuer.

Question:

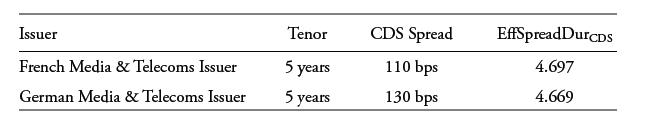

Consider the investor from the prior example who sought to underweight a French media and telecommunications issuer. Assume instead that the investor seeks to maintain a constant media and telecommunications credit allocation by overweighting a BBB rated German media and telecommunications competitor. CDS contract details are as follows:

Describe an appropriate long–short CDS strategy to meet this goal, and calculate the investor’s return if the French issuer’s spreads widen by 10 bps and those of the German issuer narrow by 25 bps based on €10 million notional contracts.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: