For Assignment 2, Alexander should conclude that Bond Z is currently: A. Undervalued. B. Fairly valued. C.

Question:

For Assignment 2, Alexander should conclude that Bond Z is currently:

A. Undervalued.

B. Fairly valued.

C. Overvalued.

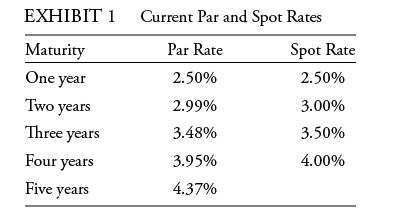

Jane Nguyen is a senior bond trader for an investment bank, and Chris Alexander is a junior bond trader at the bank. Nguyen is responsible for her own trading activities and also for providing assignments to Alexander that will develop his skills and create profitable trade ideas. Exhibit 1 presents the current par and spot rates.

Nguyen gives Alexander two assignments that involve researching various questions:

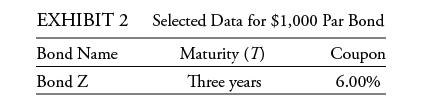

Assignment 1: What is the yield-to-maturity of the option-free, default-risk-free bond presented in Exhibit 2? Assume that the bond is held to maturity, and use the rates shown in Exhibit 1.

Assignment 2: Assuming that the projected spot curve two years from today will be below the current forward curve, is Bond Z fairly valued, undervalued, or overvalued?

After completing his assignments, Alexander asks about Nguyen’s current trading activities. Nguyen states that she has a two-year investment horizon and will purchase Bond Z as part of a strategy to ride the yield curve. Exhibit 1 shows Nguyen’s yield curve assumptions implied by the spot rates.

Step by Step Answer: