In her market research, the manager learns that ASX 3-year and 10-year Treasury bond futures are the

Question:

In her market research, the manager learns that ASX 3-year and 10-year Treasury bond futures are the most liquid products for investors trading and hedging medium- to long-term Australian dollar (AUD) interest rates. Although neither contract matches the exact characteristics of the cash bonds of her choice, which of the following additions to a barbell portfolio best positions her to gain under a bull flattening scenario?

A. Purchase a 3-year Treasury bond future matching the money duration of the short-term (2-year) position.

B. Sell a 3-year Treasury bond future matching the money duration of the short-term bond position.

C. Purchase a 10-year Treasury bond future matching the money duration of the long-term bond position.

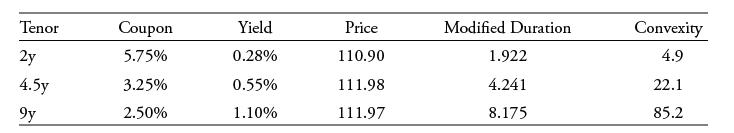

A Sydney-based fixed-income portfolio manager is considering the following Commonwealth of Australia government bonds traded on the ASX (Australian Stock Exchange):

The manager is considering portfolio strategies based upon various interest rate scenarios over the next 12 months. She is considering three long-only government bond portfolio alternatives, as follows:

Bullet: Invest solely in 4.5-year government bonds

Barbell: Invest equally in 2-year and 9-year government bonds

Equal weights: Invest equally in 2-year, 4.5-year, and 9-year bonds

Step by Step Answer: