Based on Exhibit 1, for the BI bond, one-sided: A. Up-duration will be greater than one-sided down-duration.

Question:

Based on Exhibit 1, for the BI bond, one-sided:

A. Up-duration will be greater than one-sided down-duration.

B. Down-duration will be greater than one-sided up-duration.

C. Up-duration and one-sided down-duration will be about equal.

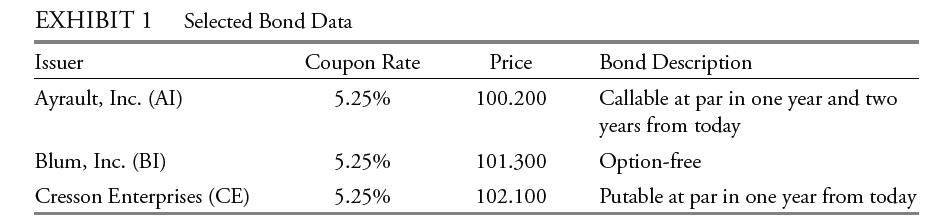

Jules Bianchi is a bond analyst for Maneval Investments, Inc. Bianchi gathers data on three corporate bonds, as shown in Exhibit 1.

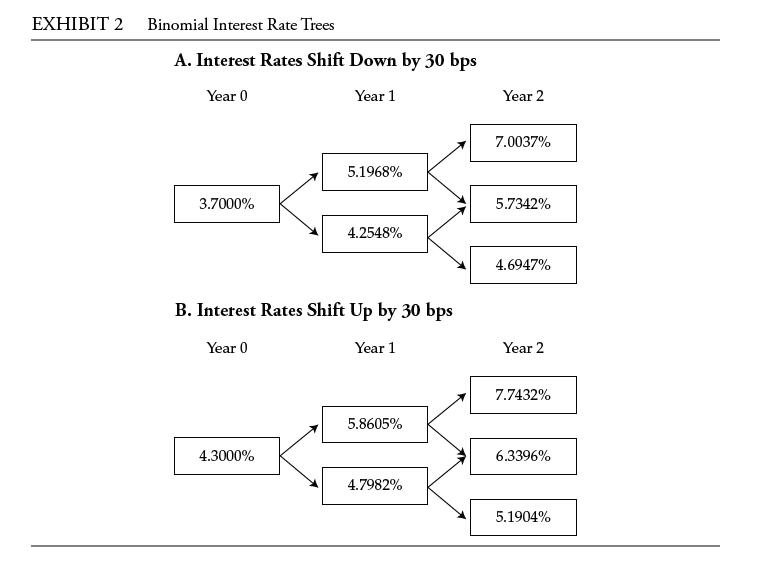

To assess the interest rate risk of the three bonds, Bianchi constructs two binomial interest rate trees based on a 10% interest rate volatility assumption and a current one-year rate of 4%. Panel A of Exhibit 2 provides an interest rate tree assuming the benchmark yield curve shifts down by 30 bps, and Panel B provides an interest rate tree assuming the benchmark yield curve shifts up by 30 bps. Bianchi determines that the AI bond is currently trading at an optionadjusted spread (OAS) of 13.95 bps relative to the benchmark yield curve.

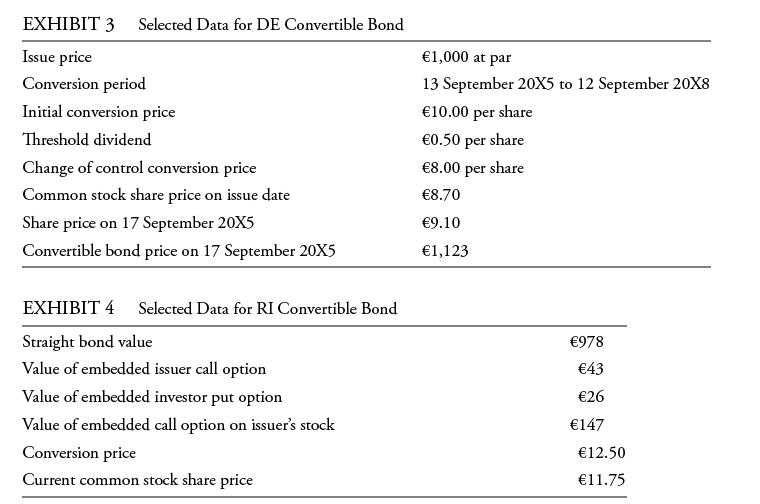

Armand Gillette, a convertible bond analyst, stops by Bianchi’s office to discuss two convertible bonds. One is issued by DeLille Enterprises (DE), and the other is issued by Raffarin Incorporated (RI). Selected data for the two bonds are presented in Exhibits 3 and 4.

Gillette makes the following comments to Bianchi:

• “The DE bond does not contain any call or put options, but the RI bond contains both an embedded call option and put option. I expect that DeLille Enterprises will soon announce a common stock dividend of €0.70 per share.”

• “My belief is that, over the next year, Raffarin’s share price will appreciate toward the conversion price but not exceed it.”

Step by Step Answer: