The following information is taken from a filing with the US Securities and Exchange Commission about a

Question:

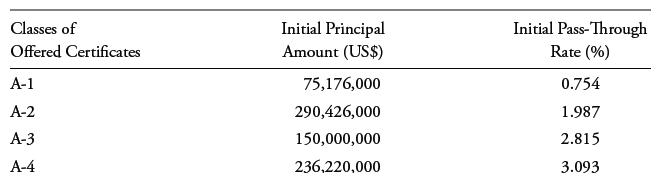

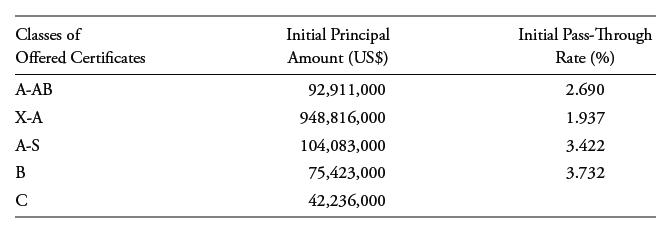

The following information is taken from a filing with the US Securities and Exchange Commission about a CMBS issued by a special purpose entity established by a major US commercial bank. The collateral for this CMBS was a pool of 72 fixed-rate mortgages secured by first liens (first claims) on various types of commercial, multifamily, and manufactured housing community properties.

The filing included the following statements:

If you acquire Class B certificates, then your rights to receive distributions of amounts collected or advanced on or in respect of the mortgage loans will be subordinated to those of the holders of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class X-A, and Class A-S certificates. If you acquire Class C certificates, then your rights to receive distributions of amounts collected or advanced on or in respect of the mortgage loans will be subordinated to those of the holders of the Class B certificates and all other classes of offered certificates.

“Prepayment Penalty Description” or “Prepayment Provision” means the number of payments from the first due date through and including the maturity date for which a mortgage loan, as applicable, (i) is locked out from prepayment, (ii) provides for payment of a prepayment premium or yield maintenance charge in connection with a prepayment, (iii) or permits defeasance.

Defeasance can be best described as:

A. A predetermined penalty that a borrower who wants to refinance must pay to do so.

B. A contractual agreement that prohibits any prepayments during a specified period of time.

C. Funds that the borrower must provide to replicate the cash flows that would exist in the absence of prepayments.

Step by Step Answer: