To meet both of Treys guidelines for the pensions bond fund investment, Serena should recommend: A. Pure

Question:

To meet both of Trey’s guidelines for the pension’s bond fund investment, Serena should recommend:

A. Pure indexing.

B. Enhanced indexing.

C. Active management.

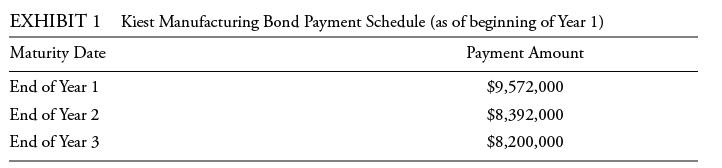

Serena is a risk management specialist with Liability Protection Advisors. Trey, CFO of Kiest Manufacturing, enlists Serena’s help with three projects. The first project is to defease some of Kiest’s existing fixed-rate bonds that are maturing in each of the next three years. The bonds have no call or put provisions and pay interest annually. Exhibit 1 presents the payment schedule for the bonds.

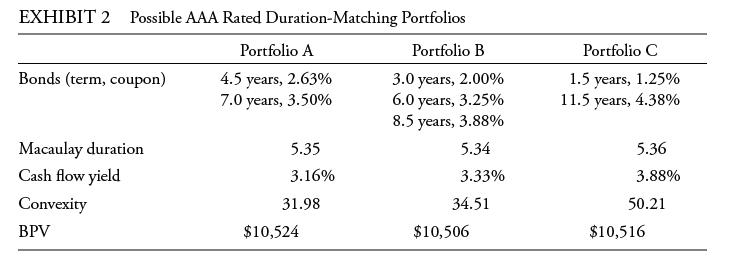

The second project for Serena is to help Trey immunize a $20 million portfolio of liabilities. The liabilities range from 3.00 years to 8.50 years with a Macaulay duration of 5.34 years, cash flow yield of 3.25%, portfolio convexity of 33.05, and basis point value (BPV) of $10,505. Serena suggested employing a duration-matching strategy using one of the three AAA rated bond portfolios presented in Exhibit 2.

Serena explains to Trey that the underlying duration-matching strategy is based on the following three assumptions.

1. Yield curve shifts in the future will be parallel.

2. Bond types and quality will closely match those of the liabilities.

3. The portfolio will be rebalanced by buying or selling bonds rather than using derivatives.

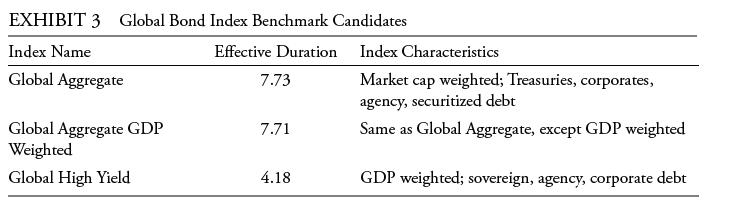

The third project for Serena is to make a significant direct investment in broadly diversified global bonds for Kiest’s pension plan. Kiest has a young workforce, and thus, the plan has a long-term investment horizon. Trey needs Serena’s help to select a benchmark index that is appropriate for Kiest’s young workforce. Serena discusses three benchmark candidates, presented in Exhibit 3.

With the benchmark selected, Trey provides guidelines to Serena directing her to (1) use the most cost-effective method to track the benchmark and (2) provide low tracking error. After providing Trey with advice on direct investment, Serena offered him additional information on alternative indirect investment strategies using (1) bond mutual funds, (2) exchange-traded funds (ETFs), and (3) total return swaps. Trey expresses interest in using bond mutual funds rather than the other strategies for the following reasons.

• Reason 1: Total return swaps have much higher transaction costs and initial cash outlay than bond mutual funds.

• Reason 2: Unlike bond mutual funds, bond ETFs can trade at discounts to their underlying indexes, and those discounts can persist.

• Reason 3: Bond mutual funds can be traded throughout the day at the net asset value of the underlying bonds.

Step by Step Answer: