3. Using the investment goal guidelines, assess the validity of Jamie Lee and Rosss short- and long-term

Question:

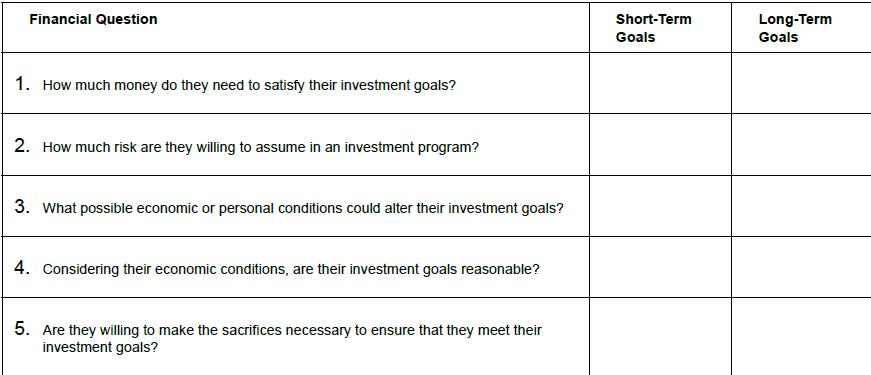

3. Using the investment goal guidelines, assess the validity of Jamie Lee and Ross’s short- and long-term financial goals and objectives (college education for the kids; retirement; and a second home).

INVESTING BASICS AND EVALUATING BONDSThe triplets are now three-and-a-half years old, and Jamie Lee and Ross, both 38, are finally beginning to settle down into a regular routine. The first three years were a blur of diapers, feedings, baths, mounds of laundry, and crying babies!

INVESTING BASICS AND EVALUATING BONDSThe triplets are now three-and-a-half years old, and Jamie Lee and Ross, both 38, are finally beginning to settle down into a regular routine. The first three years were a blur of diapers, feedings, baths, mounds of laundry, and crying babies!

Jamie Lee and Ross went out to a dinner out on the town, while Ross’s parents watched the triplets.

They had a conversation about their future and the future of the kids. They guessed that college expenses would be $100,000, and their eventual retirement is a major worry for both of them. They have dreamed of owning a beach house when they retire. That could be another $350,000, 30 years from now. They wondered how could they possibly afford all of this.

They agreed that it was time to talk to a financial planner, but they wanted to organize all of their financial information and discuss their family’s financial goals before setting up the appointment.

Current Financial Situation Assets (Jamie Lee and Ross combined):

Checking account, $4,500 Savings account, $20,000 Emergency fund savings account, $21,000 IRA balance, $32,000 Cars, $8,500 (Jamie Lee) and $14,000 (Ross)

Liabilities (Jamie Lee and Ross combined):

Student loan balance, $0 Credit card balance, $4,000 Car loans, $2,000 Income:

Jamie Lee, $45,000 gross income ($31,500 net income after taxes)

Ross, $80,000 gross income ($64,500 net income after taxes)

Monthly Expenses:

Mortgage, $1,225 Property taxes, $400 Homeowner’s insurance, $200 IRA contribution, $300 Utilities, $250 Food, $600 Baby essentials (diapers, clothing, toys, etc.), $200 Gas/Maintenance, $275 Credit card payment, $400 Car loan payment, $289 Entertainment, $125

Step by Step Answer:

Focus On Personal Finance

ISBN: 9781259919657

6th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart