11-92. Suppose you have been engaged to value a retail clothing chain as of December 31, 2012....

Question:

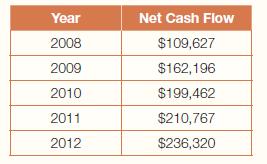

11-92. Suppose you have been engaged to value a retail clothing chain as of December 31, 2012. You have selected the capitalization of earnings method and determined that net cash flow is the appropriate measure for expected future benefits. The company’s income data for years 2008 through 2012 are presented in the table below ($ in thousands).

In order to complete your engagement, you must consider the following:

1. What is the purpose of the valuation? Create a plausible valuation scenario.

2. Given this scenario, what is the appropriate standard of value?

3. Your selection of the income approach implies what premise of value?

4. The income data in the above table would be sufficient to estimate a value as of what date (the valuation date)?

5. What percentage ownership interest are you valuing?

Is this a controlling or a minority interest?

6. Will you use a weighted or a simple average to determine the proxy benefit? Explain your rationale.

7. Using your chosen averaging method, what is the proxy benefit?

8. What expected growth rate will you use and how did you determine that rate? Assume the expected industry growth rate is 6%.

9. If you have determined a 21% required rate of return, what is the capitalization rate?

10. Using the determined proxy benefit and capitalization rate, what is the indicated value for the entire business? For the specific ownership interest you are valuing?

11. Would an adjustment for control or a discount for marketability be applicable to this ownership interest?

12. Suppose that, three months after the valuation date, the company learned that leases for several of its stores would not be renewed. How would this impact your valuation analysis?

Step by Step Answer:

Forensic Accounting

ISBN: 9781292059372

1st Global Edition

Authors: Robert J. Rufus, Bill Hahn, Laura Savory Miller, William Hahn