11-93. Reconsider the valuation of the retail clothing chain presented in the previous problem. Use the following...

Question:

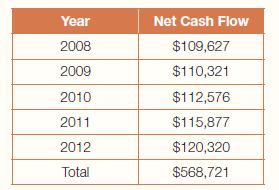

11-93. Reconsider the valuation of the retail clothing chain presented in the previous problem. Use the following benefit stream information for this purpose. You have selected the capitalization of earnings method and determined that net cash flow is the appropriate measure for expected future benefits. The company’s income data for years 2008 through 2012 are presented in the following table ($ in thousands).

1. Given the benefit stream set forth in the table, how would you determine the proxy benefit?

1. Given the benefit stream set forth in the table, how would you determine the proxy benefit?

2. If you have determined a 21% required rate of return, what is the capitalization rate? Assume the expected industry growth rate is 3%.

3. Using the determined proxy benefit and capitalization rate, what is the indicated value for the entire business? For the specific ownership interest you are valuing?

4. How does your conclusion of value compare to the one developed in the previous problem?

Step by Step Answer:

Forensic Accounting

ISBN: 9781292059372

1st Global Edition

Authors: Robert J. Rufus, Bill Hahn, Laura Savory Miller, William Hahn