AI Thomas has recently been approached by his brother-in-law, Robert Watson, with a proposal to buy a

Question:

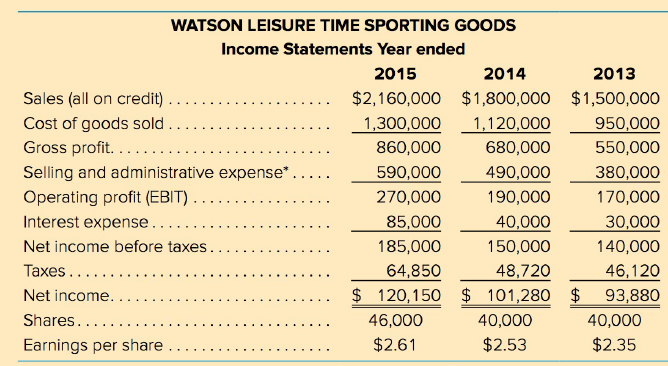

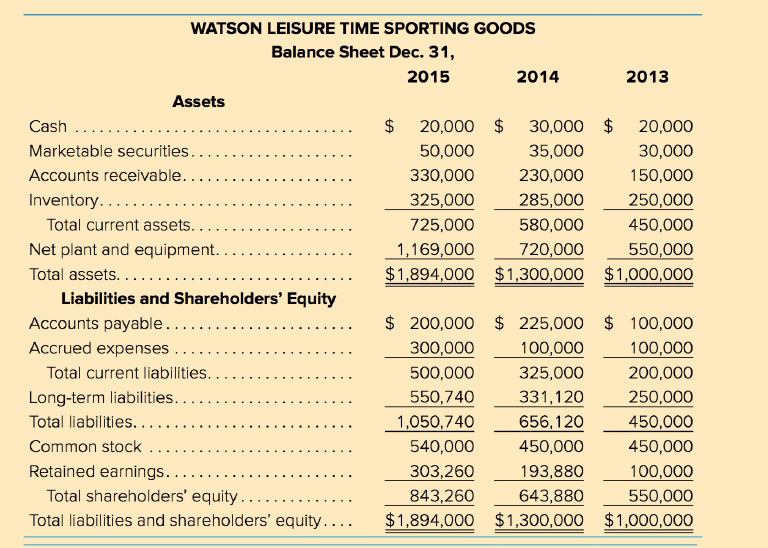

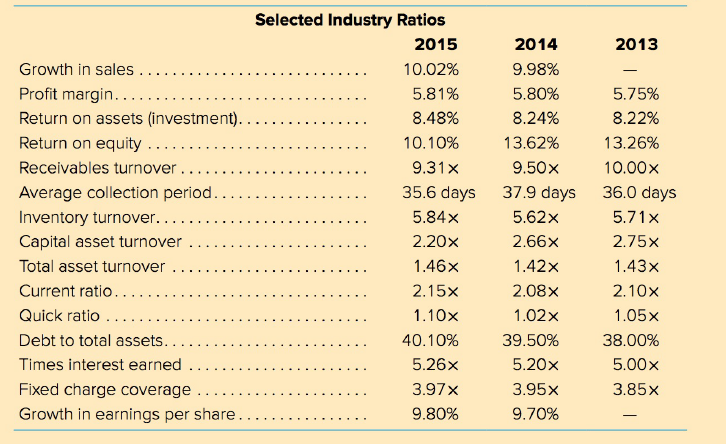

Mr. Watson is quick to point out the increase in sales that has occurred over the past three years as indicated in the following income statement. The annual growth rate is 20 percent. A balance sheet for a similar time period and selected industry ratios are also presented. Note the industry growth rate in sales is only 10 percent per year. There was a steady real growth of 2 to 3 percent in gross domestic product during the period under study. The rate of inflation was in the 3 to 4 percent range.

The stock in the corporation has become available due to the ill health of a current shareholder, who needs cash. The issue here is not to determine the exact price for the stock but rather to determine whether Watson Leisure Time Sporting Goods represents an attractive investment situation. Although Mr. Thomas has a primary interest in the profitability ratios, he will take a close look at all the ratios. He has no fast and firm rules about required return on investment; rather, he wishes to analyze the overall condition of the firm. The firm does not currently pay a cash dividend, and return to the investor must come from selling the stock in the future.

After doing a thorough analysis (including ratios for each year and comparisons to the industry), what comments and recommendations can you offer to Mr. Thomas?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: