Arrange the following items in proper balance sheet presentation: Accumulated depreciation.. Retained earnings......... Cash........ Bonds payable......... Accounts

Question:

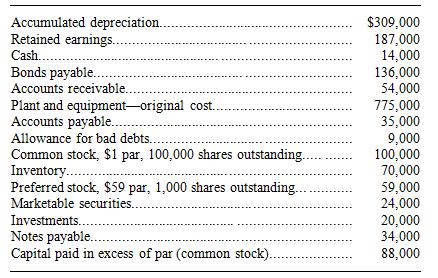

Arrange the following items in proper balance sheet presentation:

Transcribed Image Text:

Accumulated depreciation.. Retained earnings......... Cash........ Bonds payable......... Accounts receivable. Plant and equipment-original cost. Accounts payable........ Allowance for bad debts. Common stock, $1 par, 100,000 shares outstanding.. Inventory.......... Preferred stock, $59 par, 1,000 shares outstanding.. Marketable securities.. Investments.... Notes payable......... Capital paid in excess of par (common stock). $309,000 187,000 14,000 136,000 54,000 775,000 35,000 9,000 100,000 70,000 59,000 24,000 20,000 34,000 88,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Current Assets Cash Marketable securities Accounts receivable Less Allowance for ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Foundations Of Financial Management

ISBN: 9781264097623

18th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Question Posted:

Students also viewed these Business questions

-

What will the output be? Private Sub Button1_Click(...) Handles Button1. Click txtOutput.Text = "Final Exam!" End Sub

-

Arrange the following items in proper balance sheet presentation: Accumulated depreciation............................. $309,000 Retained earnings.................................... 187,000...

-

Arrange the following items in proper balance sheet presentation: Accumulated depreciation.................................................... $309,000 Retained...

-

Prepare a sensitivity analysis question with an Excel Sensitivity analysis report and answer it. Make sure your question asks about the following a. Optimal solution b. Optimal objective function c....

-

Hempstead Industries has a new milling machine with B = $110,000, n = 10 years, and S= $10,000. Determine the depreciation schedule and present worth of depreciation at i = 12% per year, using the...

-

18. Discuss why Congress has instructed taxpayers to depreciate real property using the mid-month convention as opposed to the half-year convention used for tangible personal property.

-

The price of gold. Some people recommend that investors buy gold to protect against inflation. Here are the prices of an ounce of gold at the end of the year for the years between 1985 and 2007....

-

An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her...

-

PART B: SHORT ANSWER OUESTIONS (50 MARKS) Question 1: PPE - 15 marks On January I, 2023, Westlife Furniture purchases a new delivery truck. The company pays $60,000 for the truck, sales taxes of...

-

Refer to the following financial statements for Crosby Corporation: a) Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in Table 210. b) Describe...

-

a. Swank Clothiers had sales of $375,000 and cost of goods sold of $246,000. What is the gross profit margin (ratio of gross profit to sales)? b. If the average firm in the clothing industry had a...

-

Describe the product life cycle and how it leads to new-product development.

-

Manufacturing company produces $3800 worth of products weekly. If the cost of raw materials to make this product is $400, and the labour cost is $360, calculate the productivity.

-

1-You are a very well-recognized professional in your area, with many years of experience solving international conflicts. There is a company in the middle of two European countries that are fighting...

-

Find the solution u = u(x,y) of the following problem on the set R. u du - 4, (1.4) Ju(0,y) =3y, u(x, 0) = 0. (1.5) ay

-

Scenario A Sports Club 10 Highfield Sports Club has organised a fundraising event. 300 tickets have been sold at a price of $2.50 each. Money taken at the event Percentage of money (E) taken (96)...

-

Shamrock Investments has three divisions (Green, Clover, Seamrog) organized for performance evaluation purposes as investment centers. Each division's required rate of return for purposes of...

-

Stocks C and D move in opposite directions. Does that mean they have no correlation? Explain.

-

White Bolder Investments (WBI) You are an intern working for WBI, a large investment advisory services in Sydney. Among other regular customers, WBI has been providing advisory services for Jumbo...

-

Optional-for Problem 19, use the techniques in Appendix 10A to combine a trial-and-error approach with interpolation to find a more exact answer. You may choose to use a handheld calculator instead.

-

Grant Hillside Homes, Inc., has preferred stock outstanding that pays an annual dividend of $9.80. Its price is $110. What is the required rate of return (yield) on the preferred stock?

-

Laser Optics will pay a common stock dividend of $1.60 at the end of the year (D1). The required rate of return on common stock (Ke) is 13 percent. The firm has a constant growth rate (g) of 7...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App