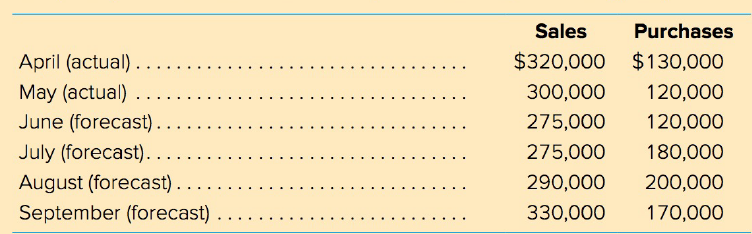

Ellis Electronics Company's actual sales and purchases for April and May are shown here, along with forecasted

Question:

The company makes 10 percent of its sales for cash and 90 percent on credit. Of the credit sales, 20 percent are collected in the month after the sale and 80 percent are collected two months after. Ellis pays for 40 percent of its purchases in the month after purchase and 60 percent two months after.

Labour expense equals 10 percent of the current month's sales. Overhead expense equals $12,000 per month. Interest payments of $30,000 are due in June and September. A cash dividend of $50,000 is scheduled to be paid in June. Tax payments of $25,000 are due in June and September. There is a scheduled capital outlay of $300,000 in September.

Ellis Electronics' ending cash balance in May is $20,000. The minimum desired cash balance is $15,000. Prepare a schedule of monthly cash receipts, monthly cash payments, and a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50,000. Excess cash (above $50,000) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall (less than $15,000).

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta