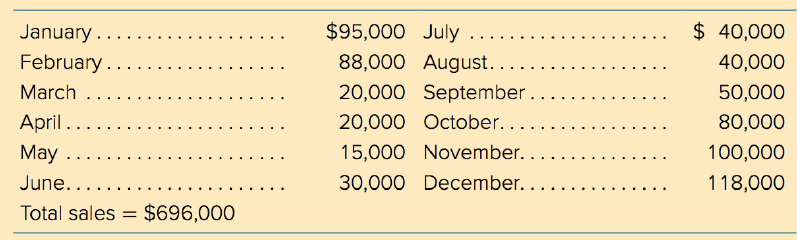

Front Page Video Games Corporation has forecasted the following monthly sales: The firm sells its Last Spike

Question:

Front Page Video Games Corporation has forecasted the following monthly sales:

The firm sells its Last Spike video game for $5 per unit, and the cost to produce the game is $2 per unit. A level production policy is followed. Each month's production is equal to annual sales (in units) divided by 12.

Of each month's sales, 30 percent are for cash and 70 percent are on account. All accounts receivable are collected in the month after the sale is made.

a. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 20,000 units. (Note: To do part a, you should work in terms of units of production and units of sales.)

b. Prepare a monthly schedule of cash receipts. Sales in the December before the planning year were $100,000. Work part busing dollars.

c. Determine a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $40,000 per month.

d. Prepare a monthly cash budget for January through December. The beginning cash balance is $5,000, and that is also the minimum desired.

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta