On graduating from college, Steven MacLean joined the financial analysis section of a large Canadian industrial concern,

Question:

a.

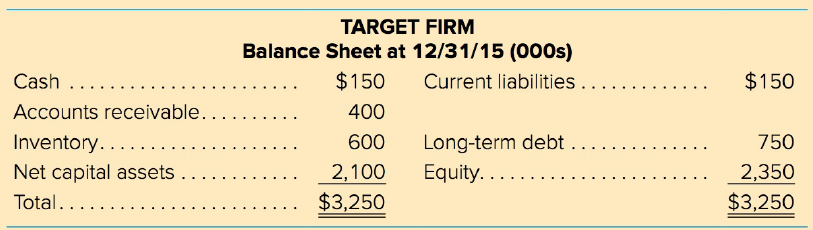

b. Target Firm's sales for 2015 had been $3.5 million, and because it was operating at full capacity, it looked as if all classes of assets would increase at a pace directly proportional to any increase in sales.

c. The interest rate on Target's long-term debt was 12.5 percent with annual interest payments being made at the end of each year.

d. MacLean recommended the long-term debt be maintained after the acquisition.

e. At the end of 2015, Target had two million shares outstanding, which had traded recently at prices around $1.50 per share.

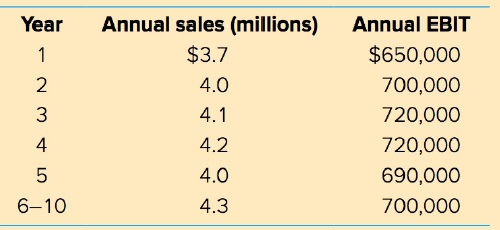

f. The following estimates of sales and earnings before interest and taxes were the most reliable MacLean had come across:

In arriving at EBIT, amortization expenses of $140,000 per year had been deducted.

g. Expenditures on capital assets would be necessary to allow for growth and to replace worn-out equipment. MacLean estimated that $200,000 per year would be required in years 1-5, with $80,000 per year thereafter.

h. The income tax rate for both firms was expected to remain at 30 percent.

i. Ontario Corporation used 13 percent as its cost of equity and had a weighted average cost of capital of 11 percent.

Compute the price MacLean should recommend that Ontario Corporation offer to pay for each of Target Firm's shares.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Cost Of Equity

The cost of equity is the return a company requires to decide if an investment meets capital return requirements. Firms often use it as a capital budgeting threshold for the required rate of return. A firm's cost of equity represents the...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta