Question: During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis consulting practice that

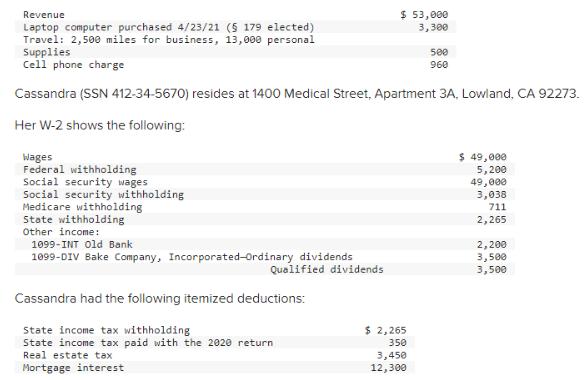

During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash-basis consulting practice that had the following income and expenses:

Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15.

Required:

Prepare Form 1040 for Cassandra for 2021, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995. Use the appropriate Tax Tables.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

SolutionInn is an online platform that provides students with access to a lib... View full answer

Get step-by-step solutions from verified subject matter experts