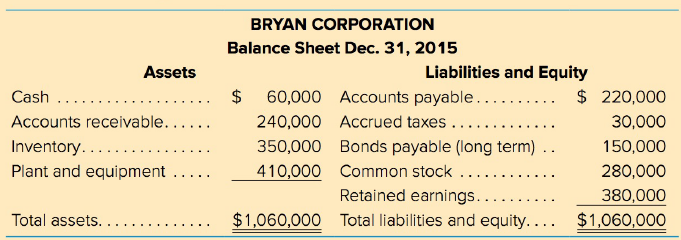

The balance sheet for Bryan Corporation is given below. Sales for the year were $3 ,040,000, with

Question:

Compute the following ratios:

a. Current ratio

b. Quick ratio

c. Debt-to-total-assets ratio

d. Asset turnover

e. Average collection period

Transcribed Image Text:

BRYAN CORPORATION Balance Sheet Dec. 31, 2015 Liabilities and Equity Assets 60,000 Accounts payable..... 240,000 Accrued taxes .... 350,000 Bonds payable (long term) .. 410,000 Common stock ... 2$ $ 220,000 Cash Accounts receivable..... 30,000 Inventory...... Plant and equipment.. 150,000 280,000 Retained earnings.. $1,060,000 Total liabilities and equity.... 380,000 $1,060,000 Total assets. ...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

a b c d e Curre...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted:

Students also viewed these Business questions

-

Top managers of Bryan Products, Inc., have asked for your help in comparing the company's profit performance and financial position with the average for the industry. The accountant has given you the...

-

The balance sheet for Kamel Corporation follows. Required Compute the following. $ 240,000 760,000 $1,000,000 $ 150,000 450,000 Current assets Long-term assets (net) Total assets Current liabilities...

-

The balance sheet for Tony Corporation is as follows. In addition, the following information for 2012 has been assembled: Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

You have $300,000 saved for retirement. Your account earns 6% interest. How much will you be able to pull out each month, if you want to be able to take withdrawals for 20 years? $ Get help: Video

-

Should Exxon abide by The Valdez Principles?

-

A grocer buys a delivery van from Homer Motors for 9,000 by bank transfer. The effect on the grocers business is to: (a) Increase a non-current asset (the delivery van) and decrease a current asset...

-

Identify the demographic and lifestyle profile of online consumers.

-

You are the senior auditor-in-charge of the July 31, 20X0, audit of Reliable Auto Parts, Inc. Your newly hired staff assistant reports to you that she is unable to complete the four-column proof of...

-

Residual Income The income from operations and the amount of invested assets in each division of Shiner Industries are as follows: Income from Operations Invested Assets Retail Division $9,350,000...

-

Use the data in LABSUP to answer the following questions. These are data on almost 32,000 black or Hispanic women. Every woman in the sample is married. It is a subset of the data used in Angrist and...

-

A firm has sales of $1.2 million, and 10 percent of the sales are for cash. The year end accounts receivable balance is $360,000. What is the average collection period?

-

The Simmons Corporation's income statement is given below. a. What is the times interest earned ratio? b. What would be the fixed charge coverage ratio? SIMMONS CORPORATION...

-

In the following exercises, (a) find the center-radius form of the equation of each circle described, and (b) graph it. Center (2, 2 B, radius 2

-

Compare the alternatives that Bergerac is considering for its decision. Include: Comparison of make versus buy option in the type of operation that Bergerac is looking to integrate. You do not need...

-

Let A, B, C and D be non-zero digits, such that CD is a two-digit positive integer. BCD is a three-digit positive integer generated by the digits B, C and D. ABCD is a four-digit positive integer...

-

1.) An aluminum tube is clamped with rigid plates using four bolts as shown. The nut on each bolt is tightened one turn from 'snug'. The thickness of the plate may be considered insignificant in this...

-

4.21 Case Study Competency IV.1RM Determine diagnosis and procedure codes and groupings according to official guidelines. Competency IV.1 Validate assignment of diagnostic and procedural codes and...

-

W.E.B Dubois taught the book called "The State" to his students at Atlanta University. Who wrote this book

-

Many managers would agree with Rajivs beliefs that performance appraisals are a nuisance and unnecessary. What are the disadvantages in doing away with performance appraisals?

-

A report from the college dean indicates that for the previous semester, the grade distribution for the Department of Psychology included 135 As, 158 Bs, 140 Cs, 94 Ds, and 53 Fs. Determine what kind...

-

Tulsa Drilling Company has $1.3 million in 12 percent convertible bonds outstanding. Each bond has a $1,000 par value. The conversion ratio is 40, the stock price is $36, and the bonds mature in 10...

-

Manpower Electric Company has 6 percent convertible bonds outstanding. Each bond has a $1,000 par value. The conversion ratio is 20, the stock price $36, and the bonds mature in 16 years. a. What is...

-

Fondren Exploration Ltd. has 1,000 convertible bonds ($1,000 par value) outstanding, each of which may be converted to 50 shares of stock. The $1 million worth of bonds has 25 years to maturity. The...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App