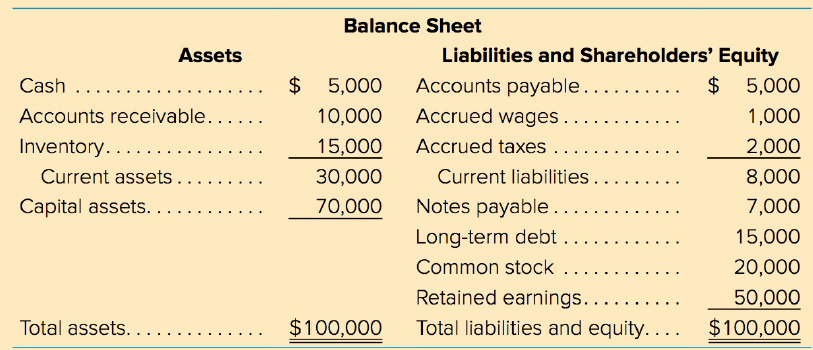

The Long branch Western Wear Company has the following financial statements, which are representative of the company's

Question:

Income Statement

Sales ........... .............................................. $200,000

Expenses ......................................................158,000

Earn ings before interest and taxes ...... . .. . . 42,000

Interest ............................ . . .............................2,000

Earnings before taxes .....................................40,000

Taxes .................... .. .. ........ .. . .. . .................20,000

Earnings after taxes ... .. .. .. .. ........ . .. .. ... $ 20,000

Dividends ............ . . .. .. .. . ....... .. . .. . ........$ 10,000

Long branch is expecting a 20 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of capital assets; instead it will be done through more efficient asset utilization in the existing stores. Of liabilities, only current liabilities vary directly with sales. (Refer to the example in the chapter and show all calculations).

a. Using a percent-of-sales method, determine whether Longbranch Western Wear has external financing needs.

b. Prepare a pro forma balance sheet with any financing adjustment made to notes payable.

c. Calculate the current ratio and total debt to assets ratio for each year.

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta