The Tyler Oil Company's capital structure is as follows: Debt..........................................................35% Preferred stock .... .. ........ . .

Question:

Debt..........................................................35%

Preferred stock .... .. ........ . . . .. .. . ....... .15

Common equity........................................50

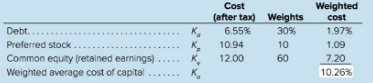

The aftertax cost of debt is 7 percent; the cost of preferred stock is 10 percent; and the cost of common equity (in the form of retained earnings) is 13 percent. Calculate Tyler Oil Company's weighted average cost of capital in a manner similar to Table 11-1.

Table 11.1

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: