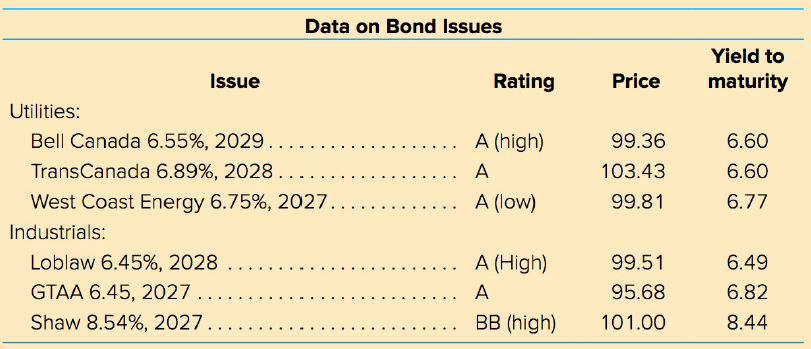

Western Electric Utility Company faces increasing needs for capital. Fortunately it has an A credit rating. The

Question:

a. Cost of debt, Kd.

b. Cost of preferred stock, KP.

c. Cost of common equity in the form of retained earnings, Ke.

d. Weighted average cost of capital.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Capital Budgeting

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Dealer

A dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: