Aldagi Corporation is an insurance company, which operates in South Caucasus region. Since 2005, the company has

Question:

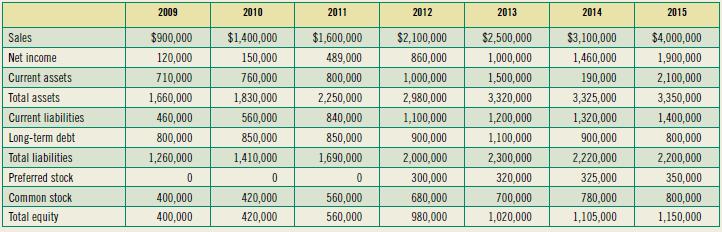

Aldagi Corporation is an insurance company, which operates in South Caucasus region. Since 2005, the company has increased its sales in the region and became a leader in health care, property-, and business-risk insurance. As of 2009, it started to build some hospitals and recently its subsidiary company is in charge of the management of three hospitals. Highlights of Aldagi’s financial condition from 2009 to 2015 are found in the accompanying table.

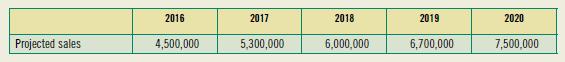

Projected Sales for 2016-2020 are as follows:

To improve its capital condition, Aldagi issued preferred stocks in 2012 and continued to increase capital in the same way until 2015. This gave Aldagi a chance to repay part of its long-term borrowings in 2014 and 2015. From 2016, the corporation will not need any additional long-term borrowings, and the entire sum needs to be repaid from 2021. So, in 2016-2020 long-term debt will be constant. Due to financial and capital conditions, Aldagi did not pay any dividends, but it is currently planning to pay a dividend of $0.5 on each share—the outstanding shares (common and preferred) at the end of 2015 total to $500,000. From 2016 we can assume that Aldagi will pay $250,000 as dividend each year. Based on the information provided:

a. Project net income for 2016–2020 using of sales method based on an average of this ration for 2009–2015.

b. Project total assets and current liabilities for 2016–2020 using the percent of sales method and your sales projections from part (a).

c. Calculate company’s discretionary financial needs for projected years.

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty