Consider this income statement: a. How does this income statement differ from the ones presented in Table

Question:

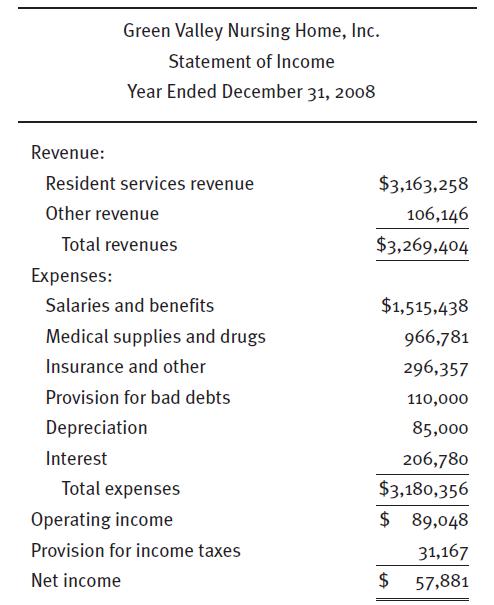

Consider this income statement:

a. How does this income statement differ from the ones presented in Table 11.1 and Problem 11.2?

b. Why does Green Valley show a provision for income taxes while the other two income statements did not?

c. What is Green Valley’s total (profit) margin? How does this value compare with the values for Park Ridge Homecare Clinic and BestCare?

d. The before-tax profit margin for Green Valley is operating income divided by total revenues. Calculate Green Valley’s before-tax profit margin.Why may this be a better measure of expense control when comparing an investor-owned business with a not-for-profit business?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: