Imagine that you were hired recently as a financial analyst for Bailey Bikes, LLC which is a

Question:

Imagine that you were hired recently as a financial analyst for Bailey Bikes, LLC which is a boutique manufacturer of carbon fiber race bikes based out of North County, San Diego. Your firm manufactures two models of road racing bikes, the Bailey 26er and the Bailey 29er. Up to this point the company has been operating without much quantitative knowledge of the business and financial risks it faces.

Cycle racing season just ended, however, and so the president of the company has started to focus more on the financial aspects of managing the business. He has set up a meeting for next week with the CFO, Gloria Pretzel, to discuss matters such as the business and financial risks faced by the company.

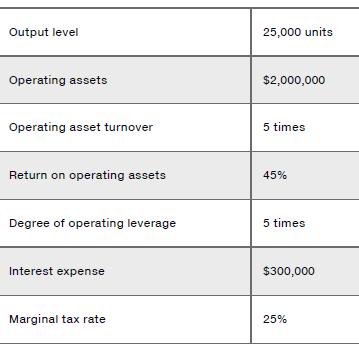

Accordingly, Gloria has asked you to prepare an analysis to assist her in her discussions with the president. As a first step in your work, you have compiled the following information regarding the cost structure of the company:

As the next step, you need to determine the break-even point in units of output for the company. One of your strong points has been that you always prepare supporting work papers that show how you arrived at your conclusions. You know Gloria would like to see these work papers to facilitate her review of your work.

Therefore, you will have the information you require to prepare an analytical income statement for the company. You are sure that Gloria would also like to see this statement. In addition, you know that you need it to be able to answer the following questions. You also know Gloria expects you to prepare, in a format that is presentable to the president, answers to the following questions to serve as a basis for her discussions with the president:

a. What is the firm’s break-even point in sales dollars?

b. If sales should increase by 20 percent (as the president expects), by what percentage would EBT (earnings before taxes) and net income increase?

c. Prepare another income statement, this time to verify the calculations from part (b).

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty