Prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended January 31, 2018.

Question:

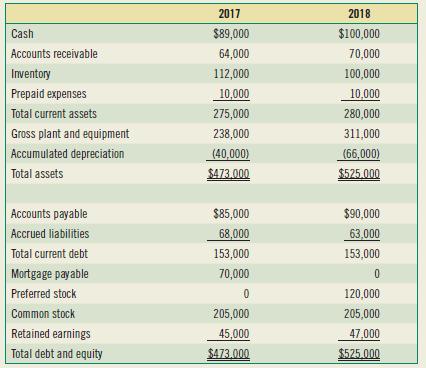

Prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended January 31, 2018. Interpret your results. Abrahams Manufacturing Company Balance Sheet for Jan. 31, 2017 and Jan. 31, 2018

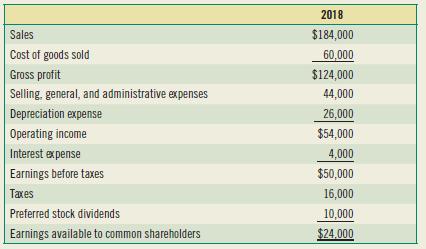

Abrahams Manufacturing Company Income Statement for the Year Ended Dec. 31, 2018

Additional Information

Additional Information

1. The only entry in the accumulated depreciation account is for 2018 depreciation.

2. The firm paid $22,000 in common stock dividends during 2018.

2017 2018 Cash $89,000 $100,000 Accounts receivable 64,000 70,000 Inventory 112,000 100,000 Prepaid expenses 10,000 10,000 Total current assets 275,000 280,000 Gross plant and equipment 238,000 311,000 Accumulated depreciation (40,000) (66,000) Total assets $473.000 $525.000 Accounts payable $85,000 $90,000 Accrued liabilities 68,000 63,000 Total current debt Mortgage payable 153,000 153,000 70,000 Preferred stock 120,000 Common stock 205,000 205,000 Retained earnings 45,000 47,000 Total debt and equity $473.000 $525.000

Step by Step Answer:

Statement of Cash Flows Cash Flow from Operating Activities Net Income 34000 Adjustments Depreciatio...View the full answer

Foundations Of Finance

ISBN: 9780135160619

10th Edition

Authors: Arthur J. Keown, John H. Martin, J. William Petty

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Prepare a statement of cash flows for the Seagull Corporation. Follow the general procedures indicated in Table your textbook. SESAGULL CORPORATION Income statement For the year ended December 31,...

-

Prepare a statement of cash flows for Mylady Ltd.

-

Prepare a statement of cash flows for the Win field Corporation for 2015. WINFIELD CORPORATION Income Statement Year Ended December 31 , 2015...

-

(a) Compute the primary Class 1 NICs payable by the following weekly-paid employees for the week ending 14 August 2020: (i) Employee A has earnings for the week of 110. (ii) Employee B has earnings...

-

Explain the physiological response to an anticipated stressor.

-

Do they have any discipline on file or public complaints?

-

Give the slope and y-intercept for each of the lines graphed LO9 in Exercise 11.5.

-

1. Describe what research design you would recommend for each of client. 2. For each research design you selected for the three clients, discuss why you believe your choice of design is the correct...

-

HELP ASAP Differential Analysis for a Discontinued Product A condensed income statement by product line for Warrick Beverage Inc. indicated the following for Mango Cola for the past year: Sales...

-

A taxpayer sold a piece of real property in year 1. The amount of year 1 real property taxes was estimated at the closing of the sale and the amounts were allocated between the buyer and the...

-

Interpret the following information regarding Maness Corporations statement of cash flows. Cash flow from operations: Net income .........................................................................

-

Given the information below for Knapp Inc.: a. How much is the firms net working capital and what is the debt ratio? b. Complete a common-sized income statement, a common-sized balance sheet, and a...

-

Page 220On 1 July 2019, Bear Island Ltd acquired a computer for an initial cost of $50 000. To make the computer more efficient in the workplace, a number of hardware modifications were necessary...

-

Define subjective brightness and brightness adaptation?

-

Write Down The Properties Of Haar Transform?

-

Explain Spatial Filtering?

-

What Is Maximum Filter And Minimum Filter?

-

Name The Categories Of Image Enhancement And Explain?

-

Express the fraction as a terminating or repeating decimal number. 11/25

-

Find the volume of the described solid S. A frustum of a right circular cone with height h, lower base radius R, and top radius r -r- --R

-

You're in need of some money fast, and rather than ask your folks for help, you've decided to look into a payday loan. At a payday loan shop right near your school you see that you can borrow $100...

-

In 2016 Bill Gates was worth about $82 billion. Let's see what Bill Gates can do with his money in the following problems. a. I'll take Manhattan? Manhattan's native tribe sold Manhattan Island to...

-

Giancarlo Stanton hit 37 home runs in 2014. If his home-run output grew at a rate of 12 percent per year, what would it have been over the following 5 years?

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App