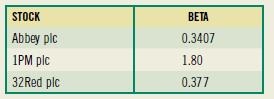

You are provided data on three companies listed in Alternative Investments Market (AIM) in the United Kingdom.

Question:

You are provided data on three companies listed in Alternative Investments Market (AIM) in the United Kingdom. Assume the risk-free rate and the market index return is 3 percent and 5 percent, respectively.

Use the CAPM to calculate the required rate of returns on the companies. What is beta on an equally weighted portfolio of the 3 stocks?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty

Question Posted: