DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following

Question:

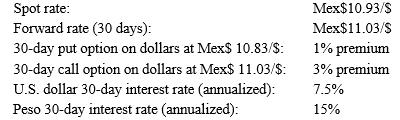

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates:

How can DKNY construct a currency collar? What is the net premium paid for the currency collar? Using this currency collar, what is the net dollar cost of the payable if the spot rate in 30 days is Mex$10.75/$? Mex$11.03/$? Mex$11.25/$?

Transcribed Image Text:

Spot rate: Forward rate (30 days): 30-day put option on dollars at Mex$ 10.83/$: 30-day call option on dollars at Mex$ 11.03/$: U.S. dollar 30-day interest rate (annualized): Peso 30-day interest rate (annualized): Mex$10.93/$ Mex$11.03/S 1% premium 3% premium 7.5% 15%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

DKNY can create a currency collar by simultaneously buying an outofthemoney put option and selling a...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted:

Students also viewed these Business questions

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: Suppose that DKNY expects the 30-day spot rate to be Mex$11.25/$. Should it...

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: What is the hedged cost of DKNYs payable using a put option? Spot rate:...

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: What is the hedged cost of DKNY's payable using a forward market hedge? Spot...

-

Exhibits 7.17 and 7.18 provide footnote excerpts to the financial reports of The Coca-Cola Company and Eli Lilly and Company that discuss the stock option grants given to the employees of the two...

-

The direct versus the indirect method of determining cash flows from operating activities The following accounts and corresponding balances were drawn from Larry Company's 2012 and 2011 y ear -end...

-

Fablus Limited makes a single product, the NL. It operates a standard absorption costing system. The budget for 2012 shows sales of 500,000 NLs at £0.25 giving a profit of £12,500. Actual...

-

and the Laspeyres index of part a on the same graph. Comment on the differences between the two indexes.

-

Gianna Tuck is an accountant for Post Pharmaceuticals. Her duties include tracking research and development spending in the new product development division. Over the course of the past six months,...

-

1. (20 points; Required) Do you think deregulation had led to a better or worse U.S. financial system? Please use at least three empirical examples to support your argument

-

International Worldwide would like to execute a money market hedge to cover a 250,000,000 shipment from Japan of sound systems it will receive in six months. The current exchange rate is 124 = $1. a....

-

Can hedging provide protection against expected exchange rate changes? Explain.

-

Before the string breaks in question 6, is there a net force acting upon the ball? If so, what is its direction? Explain.

-

A production Edgeworth Box, with origins indicated for the inputs of capital, K , and labor, L , into production of goods X and Y .Eight isoquants are shown, reflecting standard...

-

For 2014, Nichols, Inc., had sales of 150,000 units and production of 200,000 units. Other information for the year included: Direct manufacturing labor 187,500 Variable manufacturing overhead...

-

reading the following statement and decide whether you agree or disagree with the statement: "The free market system is the best economic system since it is the most efficient and solves basic...

-

find the net presbf value of the project ? present value index? Net present value A project has estimated annual net cash flows of $11,250 for 10 years and is estimated to cost $42,500. Assume a...

-

Calculate the ICER for the new treatment, without adjusting for the health utility index. Assuming the $50K benchmark*, as a clinical decision maker or health policy advisor, would you recommend...

-

The polymer formed from a diene such as 1,3-butadiene contains vinyl branches. Propose an anionic polymerization mechanism to account for the formation of these branches. CH CHCH CH CH2CH CHCH...

-

A circular concrete shaft liner with Youngs modulus of 3.4 million psi, Poissons ratio of 0.25, unconfined compressive strength 3,500 psi and tensile strength 350 psi is loaded to the verge of...

-

Consider three alternatives, each with a 10-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis. A B $150 Cost $800 $300...

-

An investor is considering buying some land for $100,000 and constructing an office building on it. Three different buildings are being analyzed. *Resale value to be considered a reduction in cost,...

-

Using benefit-cost ratio analysis, determine which one of the three mutually exclusive alternatives should be selected. Each alternative has a 6-year useful life. Assume a 10% MARR A $560 $340 $120...

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App