A machine costing $257,500 with a four-year life and an estimated $20,000 salvage value is installed in

Question:

A machine costing $257,500 with a four-year life and an estimated $20,000 salvage value is installed in • Luther Company’s factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units; year 1, 220,000; year 2, 124,600; year 3, 121,800; and year 4, 15,200. The total number of units produced by the end of year 4 exceeds the original estimate—this difference was not predicted. (The machine must not be depreciated below its es¬ timated salvage value.)

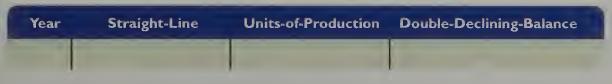

Required Prepare a table with the following column headings and compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta