Continuing with the example of Auto Boss from Question 4.10, assume that the balances after all the

Question:

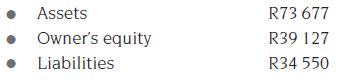

Continuing with the example of Auto Boss from Question 4.10, assume that the balances after all the transactions were:

These adjusting entries must still be processed:

1 Rent expense includes R1 140 for the next accounting period.

2 There are still oils and lubricants on hand worth R800.

3 Depreciate tools by R200, and vehicles by R500.

You are required to:

1. Enter the adjustments on the accounting equation.

2. Draft the adjusted summary statements of financial position and financial performance.

3. Calculate the expected annual return on investment that Auto Boss expects, assuming that monthly profits remain constant.

4. Comment on the output of the accounting process.

Data from Question 4.10.

Barry Nel started a business Auto Boss, specialising in repairs and services to vehicles. Record these transactions for his first month of trading on the accounting equation. Your entries must show the effect on the accounting equation.

1. Barry deposited R40 000 in the current bank account of the firm as his capital contribution.

2. Sent a cheque to the City Treasurer to pay for the trading licence, R150.

3. Issued a cheque to Hullets Trust for R4 140 to pay the rent for the first two months.

4. Paid R125 to the Postmaster for telephone expenses.

5. Bought hydraulic jacks, spanners, socket sets, etc. from Commodore Ltd to equip his workshop, R8 750 on credit.

6. Purchased the necessary oils and lubricants from Tex Oil Ltd and paid by cheque, R2 909.

7. Received an account from The Daily Dispatch for adverts placed, and paid R250 by cheque.

8. Received R3 890 in cash and cheques for cars serviced and repaired.

9. Bought a typewriter, R800 and desks and shelving, R3 500 from Modquip Ltd, and paid by cheque.

10. Bought typing ribbons on credit from Rank Xerox, R185.

11. Cashed a cheque to pay staff wages, R2 684.

12. Bought a tow-truck from CDA Ltd, R24 800 on credit.

13. Mr Brown’s car was repaired. The repairs cost him R5 680. He wrote out a cheque for R680 and agreed to pay the balance over the next five months. Barry entered the R680 on the cash register and completed an invoice for the balance.

14. Purchased a voltmeter for the workshop from Bosch Ltd, R1 500. Barry gave them a cheque for R500 in part settlement of the debt, and received an invoice for R1 000.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit