Hogan Business Systems has a small number of sales on account but is mostly a cash business.

Question:

Hogan Business Systems has a small number of sales on account but is mostly a cash business. Consequently, it uses the direct write-off method to account for uncollectible accounts. During 2011 Hogan Business Systems earned \(\$ 32,000\) of cash revenue and \(\$ 8,000\) of revenue on account. Cash operating expenses were \(\$ 26,500\). After numerous attempts to collect a \(\$ 250\) account receivable from Sam Smart, the account was determined to be uncollectible in 2012.

Required

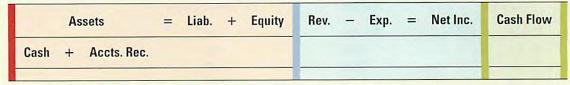

a. Record the effects of (1) cash revenue, (2) revenue on account, (3) cash expenses, and (4) write-off of the uncollectible account on the financial statements using a horizontal statements model like the one shown here. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element is not affected by the event.

b. What amount of net income did Hogan Business Systems report on the 2011 income statement?

c. Prepare the general journal entries for the four accounting events listed in Requirement \(a\).

Step by Step Answer: