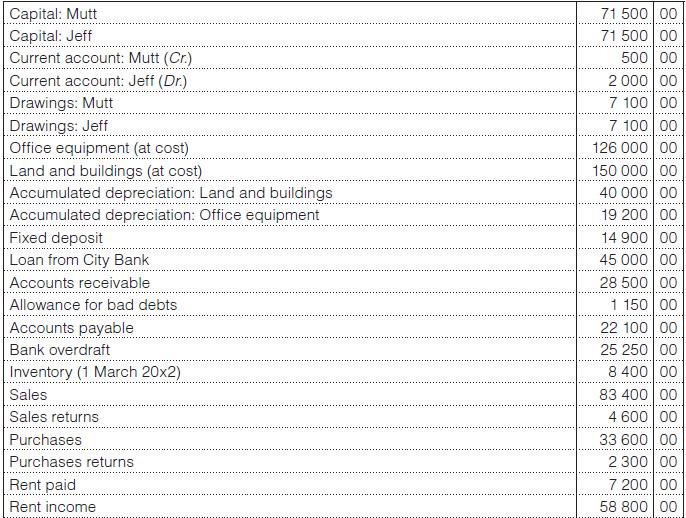

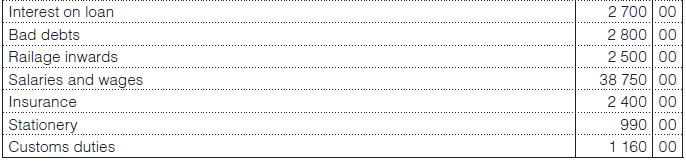

Mutt and Jeff are equal partners in a sport shop called Born Losers. These balances appeared in

Question:

Mutt and Jeff are equal partners in a sport shop called Born Losers. These balances appeared in the pre-adjustment trial balance as at 28 February 20x3: (Ignore VAT.)

Adjustments:

1. Depreciation must be provided for on:

– Land and buildings at 8% per annum on the straight-line method.

– Office equipment at 10% per annum on the reducing-balance method.

2. The loan from City Bank was negotiated on 01 March 20x2 and interest is payable sixmonthly at 12% per annum.

3. An additional amount of R1 500 must be written off from receivables as irrecoverable and the allowance for bad debts must be adjusted to be equal to 5% of ‘good receivables’.

4. The balance on the insurance account represents two premiums paid as follows:

– R900 on a one-year fire policy effective from 1 May 20x2

– R1 500 on a one-year theft policy effective from 1 August 20x2.

5. Stationery costing R180 was still on hand at 28 February 20x3.

6. An account of R240 dated 1 February 20x3 for customs duties was only received on 3 March 20x3.

7. Inventory costing R6 000 was still on hand at 28 February 20x3.

8. According to Mutt, advertisements costing R4 100 were placed before 28 February 20x3.

9. Interest on current accounts must be calculated at 6% per annum.

10. Interest on drawings came to R125 for Mutt and R100 for Jeff.

11. Transfer R1 000 to the general reserve.

You are required to:

1. Prepare the statement of profit or loss & other comprehensive income of Born Losers for the year ended 28 February 20x3.

2. Prepare the statement of financial position of Born Losers as at 28 February 20x3.

3. Prepare the statement of changes in equity of Born Losers for the year ended 28 February 20x3.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit