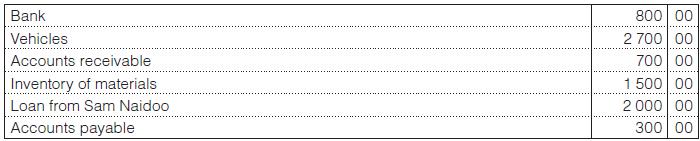

Norah Pillay had these assets and liabilities as at 1 December in her business, Pillays Poster Painting:

Question:

Norah Pillay had these assets and liabilities as at 1 December in her business, Pillay’s Poster Painting:

Transactions for December:

1 Received R800 in cash for posters painted.

3 Paid L. Munsamy, a payable, R120 by cheque.

4 Bought materials on credit, R90.

6 Norah withdrew R20 for personal use.

8 Paid for petrol by cheque, R60.

11 Paid general expense, R180.

14 L. Sans, a receivable, paid R300.

17 Paid for petrol by cheque, R50.

19 Purchased materials by cheque, R80.

21 Delivered work and invoice to Baxter Ltd, R2 400.

24 Paid 15% interest on the loan from S. Naidoo for December, January and February.

26 Paid wages and salaries, R2 100.

31 This additional information was established:

Vehicles must be depreciated by R200.

Materials on hand, R1 400.

You are required to:

1. Prepare the statement of financial position of Pillay’s Poster Paintings as at 1 December.

2. Record the transactions and adjustments for the month in the general journal.

3. Post from the general journal to the general ledger.

4. Extract a trial balance as at 31 December.

5. Enter the closing transfers of all nominal accounts in the general journal and post to the general ledger.

6. Prepare a statement of profit or loss & other comprehensive income for the month ended 31 December.

7. Prepare a statement of financial position as at 31 December.

8. Comment on the financial performance and position of Pillay’s Poster Paintings.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit