On January 1, 2011, Woodland Enterprises issued bonds with a face value of ($ 50,000), a stated

Question:

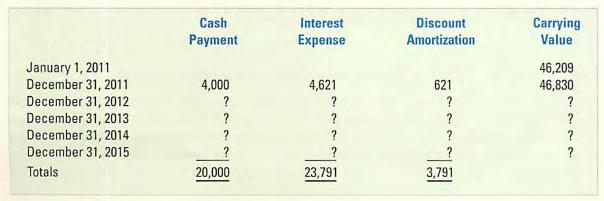

On January 1, 2011, Woodland Enterprises issued bonds with a face value of \(\$ 50,000\), a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 10 percent at the time the bonds were issued. The bonds sold for \(\$ 46,209\). Woodland used the effective interest rate method to amortize bond discount.

Required

a. Prepare an amortization table as shown below:

b. What item(s) in the table would appear on the 2012 balance sheet?

c. What item(s) in the table would appear on the 2012 income statement?

d. What item(s) in the table would appear on the 2012 statement of cash flows?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: