Refer to information in Problem 23-1 A. Required Compute these variances: (a) variable overhead spending and efficiency,

Question:

Refer to information in Problem 23-1 A.

Required Compute these variances:

(a) variable overhead spending and efficiency,

(b) fixed overhead spending and volume, and

(c) total overhead controllable.

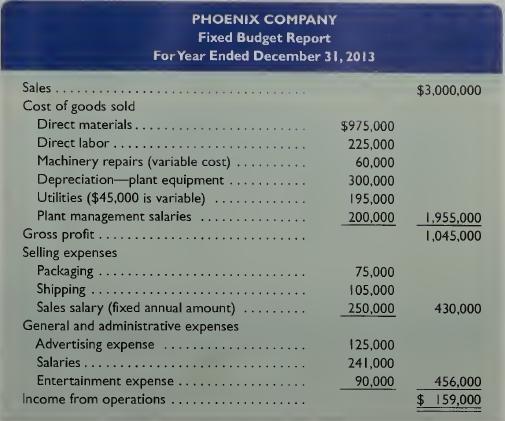

Phoenix Company’s 2013 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units.

Required 1. Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate.

2. Prepare flexible budgets (see Exhibit 23.3) for the company at sales volumes of 14,000 and 16,000 units.

3. The company’s business conditions are improving. One possible result is a sales volume of approximately 18,000 units. The company president is confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the 2013 budgeted amount of $159,000 if this level is reached without increasing capacity?

4. An unfavorable change in business is remotely possible; in this case, production and sales volume for 2013 could fall to 12,000 units. How much income (or loss) from operations would occur if sales volume falls to this level?

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta