Rose Company had no short-term investments prior to year 2013. It had the following transactions involv ing

Question:

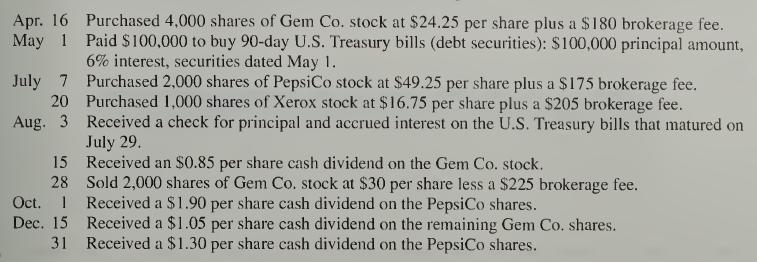

Rose Company had no short-term investments prior to year 2013. It had the following transactions involv¬ ing short-term investments in available-for-sale securities during 2013.

Required 1. Prepare journal entries to record the preceding transactions and events.

2. Prepare a table to compare the year-end cost and fair values of Rose’s short-term investments in avail¬ able-for-sale securities. The year-end fair values per share are: Gem Co., $26.50; PepsiCo, $46.50; and Xerox, $13.75.

3. Prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of short-term investments in available-for-sale securities.

Analysis Component 4. Explain the balance sheet presentation of the fair value adjustment for Rose’s short-term investments.

5. How do these short-term investments affect Rose’s

(a) income statement for year 2013 and

(b) the equity section of its balance sheet at year-end 2013?

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta