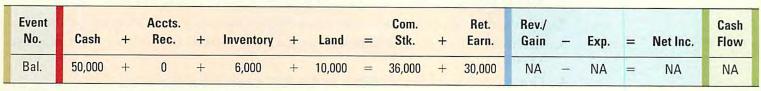

Super Buys started the 2011 accounting period with the balances given in the financial statements model shown

Question:

Super Buys started the 2011 accounting period with the balances given in the financial statements model shown below. During 2011 Super Buys experienced the following business events.

1. Paid cash to purchase \(\$ 40,000\) of merchandise inventory.

2. The goods that were purchased in Event 1 were delivered FOB destination. Freight costs of \(\$ 900\) were paid in cash by the responsible party.

3a. Sold merchandise for \(\$ 53,000\) under terms \(1 / 10, \mathrm{n} / 30\).

3b. Recognized \(\$ 36,000\) of cost of goods sold.

4a. Super Buys customers returned merchandise that was sold for \(\$ 2,500\).

4b. The merchandise returned in Event 4a had cost Super Buys \(\$ 1,500\).

5. The merchandise in Event 3a was sold to customers FOB destination. Freight costs of \(\$ 2,200\) were paid in cash by the responsible party.

6a. The customers paid for the merchandise sold in Event 3a within the discount period. Recognized the sales discount.

6b. Collected the balance in the accounts receivable account.

7. Paid cash of \(\$ 7,000\) for selling and administrative expenses.

8. Sold the land for \(\$ 8,400\) cash.

Required

a. Record the above transactions in a financial statements model like the one shown below.

b. Determine the amount of net sales.

c. Prepare a multistep income statement. Include common size percentages on the income statement.

d. Super Buys return on sales ratio in 2010 was 12 percent. Based on the common size data in the income statement, did Super Buys' expenses increase or decrease in 2011?

e. Explain why the term loss is used to describe the results due to the sale of land.

Step by Step Answer: