Tharp Field is jointly owned by Gavin Company (70% WI), which acts as field operator, and Garza

Question:

Tharp Field is jointly owned by Gavin Company (70% WI), which acts as field operator, and Garza Company (30% WI). There is a 1/6 royalty. The 1/6 royalty is shared proportionally by Gavin and Garza. The two working interest owners have agreed that Gavin’s purchaser will take gas produced in July, and Garza’s purchaser will take gas produced in August. Gas allocations will be equalized in September. Assume each working interest owner receives payment only for gas delivered to his purchaser(s). Ignore severance taxes.

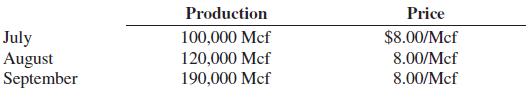

Gross production and gas prices were as follows:

REQUIRED:

a. Prepare the gas balance report for Gavin Company to summarize the production deliveries and equalization of gas for July through September.

b. Prepare the journal entries for each company during the three-month period, assuming that both companies use the sales method for both revenue and royalty.

c. Prepare the journal entries for each company during the three-month period, assuming that both companies use the entitlement method for both revenue and royalty.

Step by Step Answer: