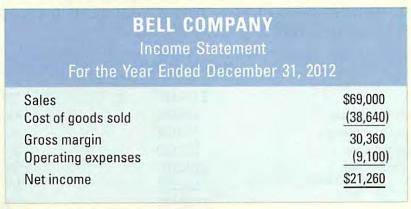

The following income statement was prepared for Bell Company for the year 2012: During the year-end audit,

Question:

The following income statement was prepared for Bell Company for the year 2012:

During the year-end audit, the following errors were discovered.

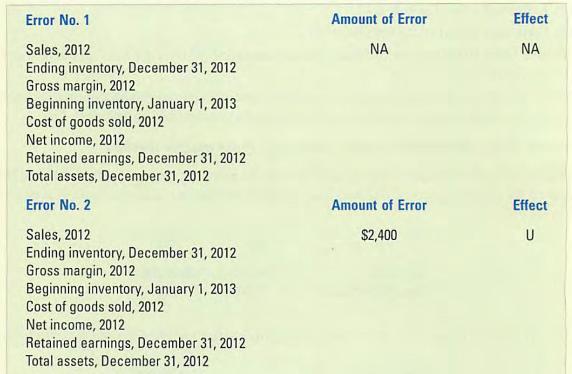

1. A \(\$ 1,400\) payment for repairs was erroneously charged to the Cost of Goods Sold account. (Assume that the perpetual inventory system is used.)

2. Sales to customers for \(\$ 2,400\) at December 31,2012 , were not recorded in the books for 2012. Also, the \(\$ 1,344\) cost of goods sold was not recorded. The error was not discovered in the physical count because the goods had not been delivered to the customer.

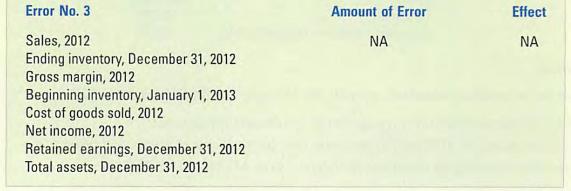

3. A mathematical error was made in determining ending inventory. Ending inventory was understated by \(\$ 1,200\). (The Inventory account was written down in error to the Cost of Goods Sold account.)

Required

Determine the effect, if any, of each of the errors on the following items. Give the dollar amount of the effect and whether it would overstate (O), understate (U), or not affect (NA) the account. The effect on sales is recorded as an example.

Step by Step Answer: