The following information pertains to Porter Company for 2011. Ending inventory consisted of 30 units. Porter sold

Question:

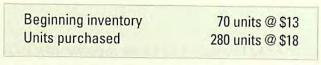

The following information pertains to Porter Company for 2011.

Ending inventory consisted of 30 units. Porter sold 320 units at \(\$ 30\) each. All purchases and sales were made with cash.

Required

a. Compute the gross margin for Porter Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average.

b. What is the dollar amount of difference in net income between using FIFO versus LIFO? (Ignore income tax considerations.)

c. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement \(a\). Ignore the effect of income taxes. Explain why these cash flows have no differences.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: