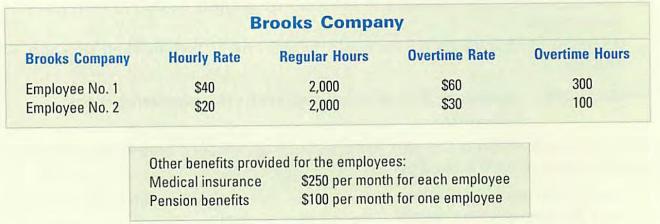

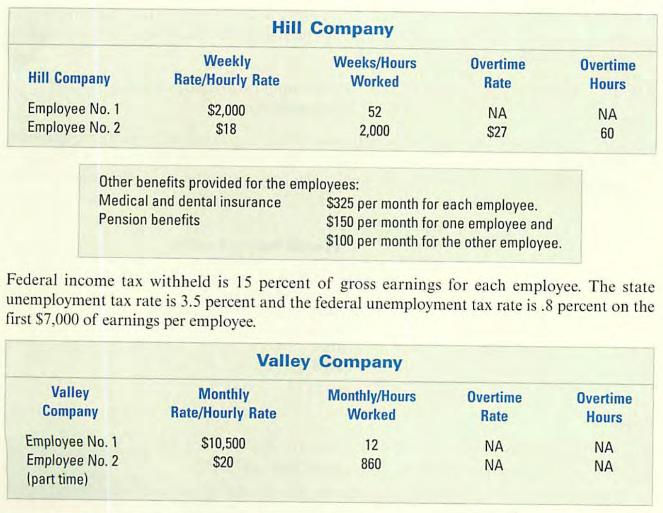

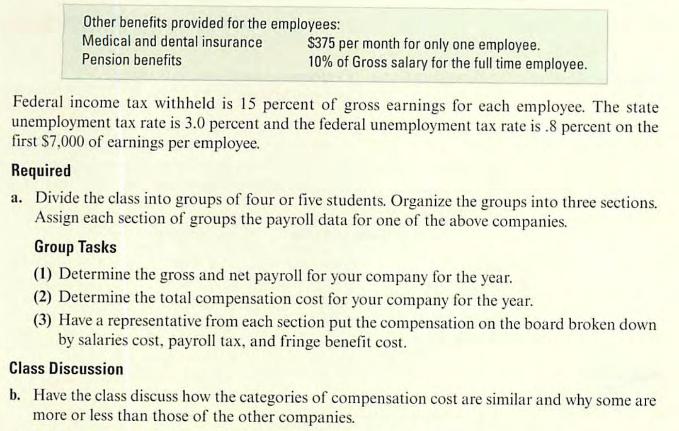

The following payroll information is available for three companies for 2011. Each company has two employees. Assume

Question:

The following payroll information is available for three companies for 2011. Each company has two employees. Assume that the Social Security tax rate is 6 percent on the first \(\$ 110,000\) of earnings and the Medicare tax rate is 1.5 percent on all earnings.

Federal income tax withheld is 15 percent of gross earnings for each employee. The state unemployment tax rate is 3.5 percent and the federal unemployment tax rate is .8 percent on the first \(\$ 7,000\) of earnings per employee.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: