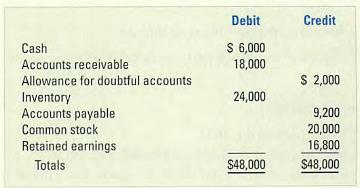

The following post-closing trial balance was drawn from the accounts of Spruce Timber Co. as of December

Question:

The following post-closing trial balance was drawn from the accounts of Spruce Timber Co. as of December 31, 2011.

Transactions for 2012

1. Acquired an additional \(\$ 10,000\) cash from the issue of common stock.

2. Purchased \(\$ 60,000\) of inventory on account.

3. Sold inventory that cost \(\$ 62,000\) for \(\$ 95,000\). Sales were made on account.

4. Wrote off \(\$ 1,100\) of uncollectible accounts.

5. On September 1 , Spruce loaned \(\$ 9,000\) to Pine Co. The note had a 7 percent interest rate and a one-year term.

6. Paid \(\$ 15,800\) cash for salaries expense.

7. Collected \(\$ 80,000\) cash from accounts receivable.

8. Paid \(\$ 52,000\) cash on accounts payable.

9. Paid a \(\$ 5,000\) cash dividend to the stockholders.

10. Accepted credit cards for sales amounting to \(\$ 3,000\). The cost of goods sold was \(\$ 2,000\). The credit card company charges a \(4 \%\) service charge. The cash has not been received.

11. Estimated uncollectible accounts expense to be 1 percent of sales on account.

12. Recorded the accrued interest at December 31, 2012.

Required

a. Record the above transactions in general journal form.

b. Open T-accounts and record the beginning balances and the 2012 transactions.

c. Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for 2012.

Step by Step Answer: