Question:

The following transactious and events affect the partners capital accounts in several successive partnerships. Prepare a table with six columns, one for each of the five partners along with a total column to show the effects of the following events on the five partners’ capital accounts.

Part 1 4/13/2011 Ries and Bax create R&B Company. Each invests $ I (),()()(), and they agree to share income and losses equally, 12/31/2011 R&B Co. earns ,$15,000 in income for its first year. Ries withdraws $4,000 from the partnership, and Bax withdraws $7,000.

1/1/2012 Royee is made a partner in RB&R Company after contributing $12,000 cash. The partners agree that a interest allowance will be given on each partner’s beginning-year capital balance. In addition, Bax and Royce are to receive $5,000 salary allowances. The remainder of the income or loss is to be divided evenly.

Part 2 Journalize the events affecting the partnership for the year ended December 31, 2012,

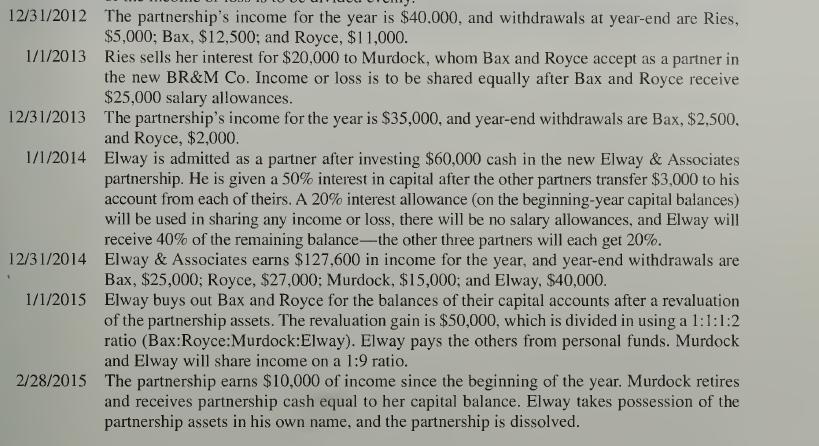

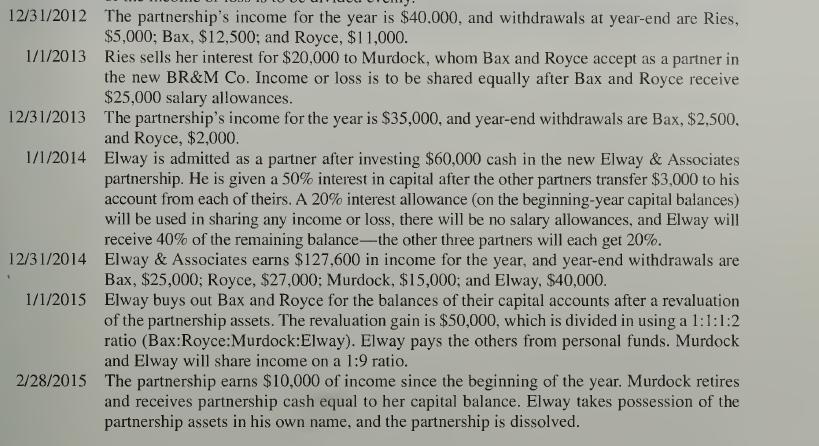

Transcribed Image Text:

12/31/2012 The partnership's income for the year is $40.000, and withdrawals at year-end are Ries, $5,000; Bax, $12,500; and Royce, $11,000. 1/1/2013 Ries sells her interest for $20,000 to Murdock, whom Bax and Royce accept as a partner in the new BR&M Co. Income or loss is to be shared equally after Bax and Royce receive $25,000 salary allowances. 12/31/2013 The partnership's income for the year is $35,000, and year-end withdrawals are Bax, $2,500, and Royce, $2,000. 1/1/2014 Elway is admitted as a partner after investing $60,000 cash in the new Elway & Associates partnership. He is given a 50% interest in capital after the other partners transfer $3,000 to his account from each of theirs. A 20% interest allowance (on the beginning-year capital balances) will be used in sharing any income or loss, there will be no salary allowances, and Elway will receive 40% of the remaining balance-the other three partners will each get 20%. 12/31/2014 Elway & Associates earns $127,600 in income for the year, and year-end withdrawals are Bax, $25,000; Royce, $27,000; Murdock, $15,000; and Elway, $40,000. 1/1/2015 Elway buys out Bax and Royce for the balances of their capital accounts after a revaluation of the partnership assets. The revaluation gain is $50,000, which is divided in using a 1:1:1:2 ratio (Bax:Royce:Murdock:Elway). Elway pays the others from personal funds. Murdock and Elway will share income on a 1:9 ratio. 2/28/2015 The partnership earns $10,000 of income since the beginning of the year. Murdock retires and receives partnership cash equal to her capital balance. Elway takes possession of the partnership assets in his own name, and the partnership is dissolved.