This year Bertrand Company sold 40,000 units of its only product for $25 per unit. Manufacturing and

Question:

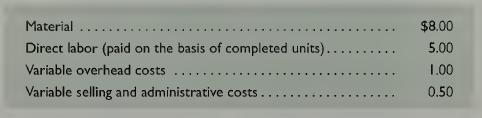

This year Bertrand Company sold 40,000 units of its only product for $25 per unit. Manufacturing and selling the product required $200,000 of fixed manufacturing costs and $325,000 of fixed selling and administrative costs. Its per unit variable costs follow.

Next year the company will use new material, which will reduce material costs by 50% and direct labor costs by 60% and will not affect product quality or marketability. Management is considering an in¬ crease in the unit sales price to reduce the number of units sold because the factory’s output is nearing its annual output capacity of 45,000 units. Two plans are being considered. Under plan 1, the company will keep the price at the current level and sell the same volume as last year. This plan will increase income because of the reduced costs from using the new material. Under plan 2, the company will in¬ crease price by 20%. This plan will decrease unit sales volume by 10%. Under both plans 1 and 2, the total fixed costs and the variable costs per unit for overhead and for selling and administrative costs will remain the same.

Required 1. Compute the break-even point in dollar sales for both

(a) plan 1 and

(b) plan 2.

2. Prepare a forecasted contribution margin income statement with two columns showing the expected results of plan 1 and plan 2. The statements should report sales, total variable costs, contribution margin, total fixed costs, income before taxes, income taxes (30% rate), and net income.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta