Jobs, Alford, and Norris formed the JAN Partnership to provide landscape design services in Edmonton, by making

Question:

Jobs, Alford, and Norris formed the JAN Partnership to provide landscape design services in Edmonton, by making capital contributions of $150,000, $100,000, and $250,000, respectively, on January 7, 2020. They anticipate annual profit of $240,000 and are considering the following alternative plans of sharing profit and losses:

a. Equally;

b. In the ratio of their initial investments (do not round the ratio calculations); or

c. Salary allowances of $70,000 to Jobs, $40,000 to Alford, and $90,000 to Norris; interest allowances of 10% on initial investments, with any remaining balance shared equally.

Required

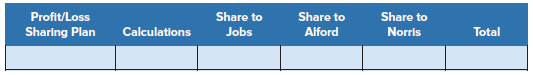

1. Prepare a schedule with the following column headings:

Use the schedule to show how a profit of $240,000 would be distributed under each of the alternative plans being considered. Round your answers to the nearest whole dollar.

2. Prepare a statement of changes in equity showing the allocation of profit to the partners, assuming they agree to use alternative (c) and the profit actually earned for the year ended December 31, 2020, is $240,000. During 2020, Jobs, Alford, and Norris withdrew $50,000, $40,000, and $60,000, respectively.

3. Prepare the December 31, 2020, journal entry to close Income Summary, assuming they agree to use alternative (c) and the profit is $240,000. Also, close the withdrawals accounts.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann