Poppy, Sweetbean, and Olive have always shared profit and losses in a 3:1:1 ratio. They recently decided

Question:

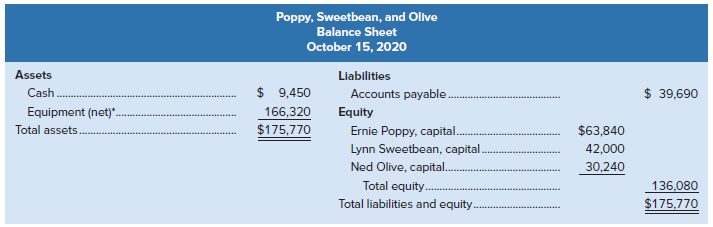

Poppy, Sweetbean, and Olive have always shared profit and losses in a 3:1:1 ratio. They recently decided to liquidate their partnership. Just prior to the liquidation, their balance sheet appeared as follows:

Required

Part 1

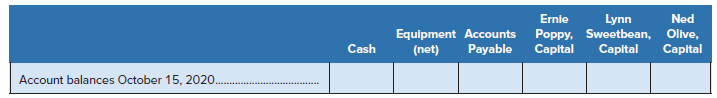

Under the assumption that the equipment is sold and the cash is distributed to the proper parties on October 15, 2020, complete the schedule provided below.

Show the sale, the gain or loss allocation, and the distribution of the cash in each of the following unrelated cases:

a. The equipment is sold for $189,000.

b. The equipment is sold for $119,070.

c. The equipment is sold for $50,820, and any partners with resulting deficits can and do pay in the amount of their deficits.

d. The equipment is sold for $38,640, and the partners have no assets other than those invested in the business.

Part 2

Prepare the entry to record the final distribution of cash assuming case (a) above.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann