Refer to the information in Exercise 21-16. 1. Assume Hudson Co. has a target pretax income of

Question:

Refer to the information in Exercise 21-16.

1. Assume Hudson Co. has a target pretax income of $162,000 for 2020. What amount of sales (in dollars) is needed to produce this target income?

2. If Hudson achieves its target pretax income for 2020, what is its margin of safety (in percent)? (Round to one decimal place.)

Data from Exercise 21-16

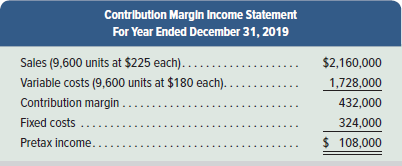

Hudson Co. reports the contribution margin income statement for 2019 below. Using this information, compute HudsonCo.’s

Transcribed Image Text:

Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (9,600 units at $225 each)..... $2,160,000 Variable costs (9,600 units at $180 each). 1,728,000 Contribution margin .... 432,000 Fixed costs 324,000 $ 108,000 Pretax income..

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

1 2 Dollar sales for ta...View the full answer

Answered By

Ajeet Singh

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students. Areas of interest: Business, accounting, Project management, sociology, technology, computers, English, linguistics, media, philosophy, political science, statistics, data science, Excel, psychology, art, history, health education, gender studies, cultural studies, ethics, religion. I am also decent with math(s) & Programming. If you have a project you think I can take on, please feel welcome to invite me, and I'm going to check it out!

5.00+

4+ Reviews

24+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Refer to the information in Exercise 21-16. The marketing manager believes that increasing advertising costs by $81,000 in 2020 will increase the companys sales volume to 11,000 units. Prepare a...

-

Rivera Co. sold 20,000 units of its only product and incurred a $50,000 loss (ignoring taxes) for the current year, as shown here. During a planning session for year 2020s activities, the production...

-

On January 1, 2019, when the market rate for bond interest was 14%, Lenoir Corporation issued bonds in the face amount of $500,000 with interest at 12% payable semiannually. The bonds mature on...

-

SG Company acquired 80% of Popsters Company on January 1, 2019, when the stockholders equity of Popsters consisted of: Ordinary shares, P100 par P500,000 Paid in capital in excess of par 400,000...

-

The upper surface of a cube of gelatin, 5.0 cm on a side, is displaced 0.64 cm by a tangential force. If the shear modulus of the gelatin is 940 Pa, what is the magnitude of the tangential force?

-

Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years ago Kevin married Karen, and she has lived in the house since their marriage. If they sell Kevins...

-

Prepare and prove the accuracy of subsidiary ledgers. (p. E-9) AppendixLO1

-

Shaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use;...

-

When there has been an overestimation of factory overhead, the amount of over-applied overhead is A B C D added to the net profit figure deducted from the net profit figure added to the cost of goods...

-

A solution was prepared by dissolving 5.76 g of KCl MgCl2 6H2O (277.85 g/mol) in sufficient water to give 2.000 L. Calculate (a) The molar analytical concentration of KCl MgCl2 in this solution....

-

Hudson Co. reports the contribution margin income statement for 2019 below. Using this information, compute HudsonCo.s (1) Break-even point in units (2) Break-even point in sales dollars....

-

Refer to the information in Exercise 21-16. 1. Compute the companys degree of operating leverage for 2019. 2. If sales decrease by 5% in 2020, what will be the companys pretax income? 3. Assume sales...

-

Suggest how storage for elements can be allocated and deal located within the hash table itself by linking all unused slots into a free list. Assume that one slot can store a flag and either one...

-

The break even point of a company is $240 000. They sell their product at a markup of 30% and have variable expenses of 9% of sales. They currently make a profit of $10 500. They plan on reducing...

-

What kind of messages are young girls and boys receiving about whether their safety in relationships is valued are by their families and communities? Do we emphasize to our children (boys and girls)...

-

Below are the transactions for Oliver Printing, Incorporated for June, the first month of operations. June 1 Obtain a loan of $ 5 6 , 0 0 0 from the bank by signing a note. June 2 Issue common stock...

-

Assume an organization must invest $ 7 0 0 , 0 0 0 in fixed costs to produce a product that sells for $ 7 5 and requires $ 4 0 in variable costs to produce one unit. What is the organization s...

-

hotel delta marriott montreal What do you think is the value and purpose for the hotel brand choosing to make CSR an important part of their overall business strategy? What two recommendations based...

-

In Problem use the given annual interest rate r and the compounding period to find i, the interest rate per compounding period. 2.94% compounded semiannually

-

d) For die casting processes: 1. What are the most common metals processed using die casting and discuss why other metals are not commonly die casted? 2. Which die casting machines usually have a...

-

When recording a corporations income taxes for the year, (a) Why would Deferred Income Tax Payable be credited? (b) How is Deferred Income Tax Payable reported in the financial statements?

-

Phelps Corporation owns all of the common stock of Stern Company. Each company maintains its own accounting records and prepares separate financial statements. Balance sheets for each company as of...

-

Yes, the three legs of the organizational architecture stool were out of balance. As a result, the airline lost tens of thousands of dollars in revenues. Decision rights regarding repair work were...

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Gleim CPA Review Financial Accounting And Reporting 2018 2018 Edition - ISBN: 1618541498 - Free Book

Study smarter with the SolutionInn App