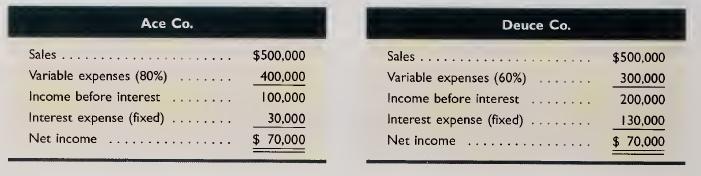

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay

Question:

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay no income taxes):

Required 1. Compute times interest earned for Ace Co.

2. Compute times interest earned for Deuce Co.

3. What happens to each company’s net income if sales increase by 30%?

4. What happens to each company’s net income if sales increase by 50%?

5. What happens to each company’s net income if sales increase by 80%?

6. What happens to each company’s net income if sales decrease by 10%?

7. What happens to each company’s net income if sales decrease by 20%?

8. What happens to each company’s net income if sales decrease by 40%?

Analysis Component 9. Comment on the results from parts 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta