Use Apples financial statements in Appendix A to answer the following. 1. How many shares of Apple

Question:

Use Apple’s financial statements in Appendix A to answer the following.

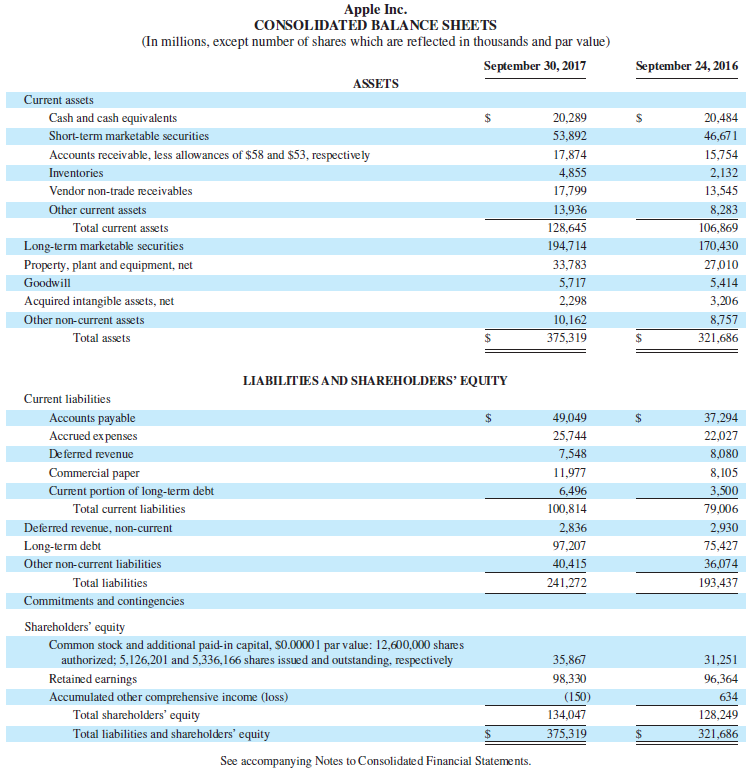

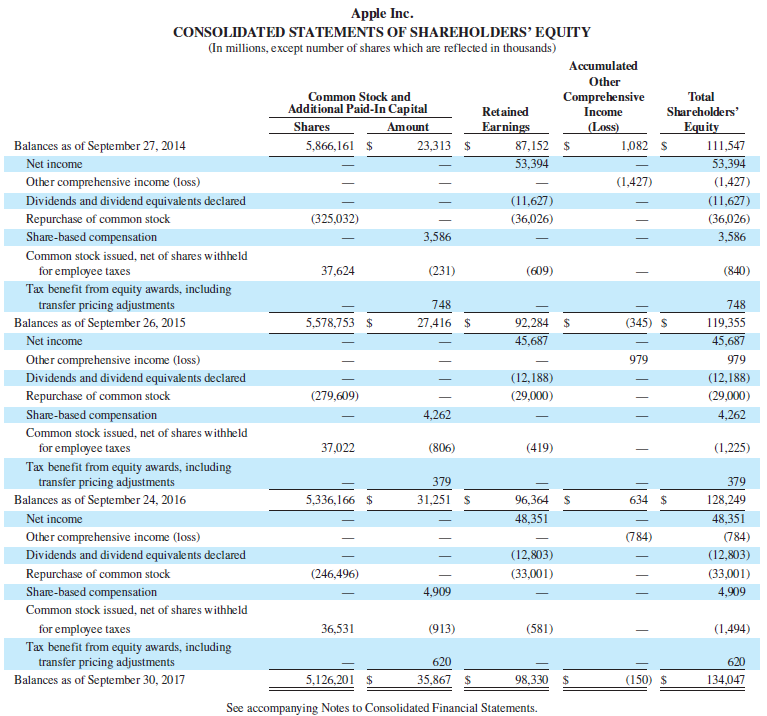

1. How many shares of Apple common stock are issued and outstanding at (a) September 30, 2017, and (b) September 24, 2016?

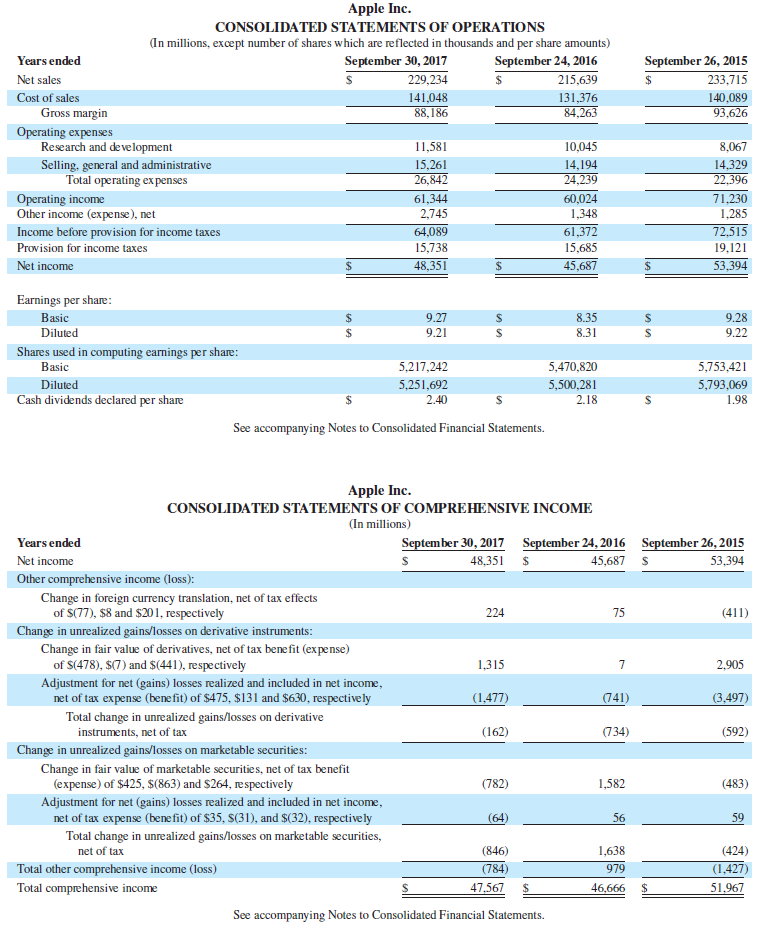

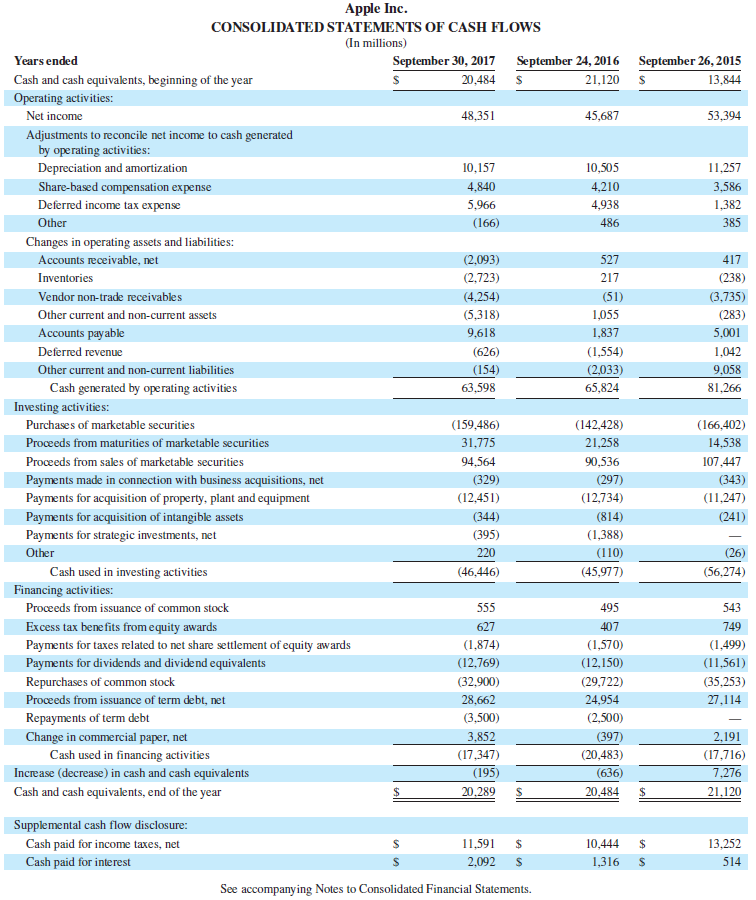

2. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 30, 2017, and (b)September 24, 2016?

3. Identify basic EPS amounts for fiscal years (a) 2017 and (b) 2016.

4. Is the change in Apple’s EPS from 2016 to 2017 favorable or unfavorable?

5. If Apple buys back outstanding shares from investors, would you expect EPS to increase or decrease from the buyback?

Data from Apple's

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 30, 2017 ASSETS Current assets 24 20,484 Cash and cash equivalents 20,289 53,892 Short-term marketable securities 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 128,645 Total current assets 106,869 170,430 Long-term marketable securities 194,714 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 2.298 Acquired intangible assets, net 3,206 Other non-current assets 10,162 8,757 375,319 Total assets 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 7,548 De ferred revenue 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 100,814 Total current liabilities 79,006 Deferred revenue, non-current 2,836 2,930 97,207 Long-term debt 75,427 Other non-current liabilities 40,415 36,074 193,437 Total liabilities 241,272 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 30, 2017 September 24, 2016 September 26, 2015 Net sales 229,234 215,639 24 233,715 Cost of sales 141,048 131,376 84,263 140,089 93,626 Gross margin 88,186 Operating expenses Research and development 11,581 10,045 8,067 Selling, general and administrative Total operating ex penses 15,261 26,842 14,194 24,239 14,329 22.396 Operating income Other income (expense), net 60,024 1,348 71,230 61,344 2,745 1,285 Income before provision for income taxes 64,089 61,372 72,515 Provision for income taxes 15,738 15,685 19,121 Net income 48,351 45,687 53,394 Earnings per share: Basic Diluted %24 9.27 8.35 %24 9.28 9.21 8.31 9.22 Shares used in computing earnings per share: Basic 5,217,242 5,470,820 5,753,421 Diluted 5,251,692 5,500,281 5,793,069 Cash dividends declared per share 2.40 2.18 1.98 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 30, 2017 September 24, 2016 September 26, 2015 Years ended Net income 48,351 45,687 S 53,394 Other comprehensive income (loss): Change in foreign currency translation, net of tax effects of S(77), $8 and $201, respectively 224 75 (411) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit (expense) of S(478), $(7) and $(441), respectively 1,315 2,905 Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $475, $131 and $630, respective ly Total change in unrealized gains/losses on derivative instruments, net of tax (1,477) (741) (3,497) (162) (734) (592) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit (expense) of $425, $(863) and $264, respectively (782) 1,582 (483) Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $35, S(31), and $(32), respectively Total change in unrealized gains/losses on marketable securities, net of tax (64) 56 59 (846) 1,638 (424) Total other comprehensive income (loss) (784) 979 (1,427 Total comprehensive income 47,567 46,666 51,967 See accompanying Notes to Consolidated Financial Statements.

Step by Step Answer:

All shares in thousands 1 a 5126201 common stock outstanding b 5336166 common stock outstan...View the full answer

Related Video

A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn\\\\\\\'t need to fund operations and other investments.This video will give you detailed overview about how stock buy back works and how it is useful tool for companies to raise capital .

Students also viewed these Business questions

-

Use the following comparative figures for Apple and Google. Required 1. Compute the book value per common share for each company using these data. 2. Compute the basic EPS for each company using...

-

Refer to the statements for Google in Appendix A. For the year ended December 31, 2017,what was its debt-to-equity ratio? What does this ratio tell us? Data from Google's Google Inc. (Alphabet Inc.)...

-

Refer to the information in Exercise 13-6. Assume that instead of distributing a stock dividend, Sharper did a 3-for-1 stock split. After the split, (1) prepare the updated stockholders equity...

-

1. Which type contains a single character enclosed within single quotes? A. Character B. Numeric C. Floating point 2. The modulus operator uses, B. - B. < A. + 3. Every variable should be separated...

-

A new dormitory is being built at a college in North Carolina. To save costs, it is proposed to not include air conditioning ducts and vents. A member of the board overseeing the construction says...

-

A diagram shows a curve C with parametric equations a. Find a Cartesian equation of the curve in the form y = f(x), and state the domain of f(x). b. Show that c. Hence determine the range of f(x). x...

-

12. Unrealized profit in the ending inventory is eliminated in consolidation workpapers by increasing cost of sales and decreasing the inventory account. How is unrealized profit in the beginning...

-

Given the activities whose sequence is described by the following table, draw the appropriate activity-on-arrow (AOA) network diagram. (a) Which activities are on the critical path? (b) What is the...

-

IRS Practice & Procedure What must happen before an assessment and collection of a deficiency can properly occur?

-

Consider the following 0x86 program: .data array DWORD 1,2,3,4,5,6,7,8,9 aravSize -(S-array)/4 ; array .code main PROC mov ecx,arraySize-1 mov esi.OFFSET array L1: mov eax. [esi] sda mov bx,2 idiv bx...

-

Santana Rey created Business Solutions on October 1, 2019. The company has been successful, and Santana plans to expand her business. She believes that an additional $86,000 is needed and is...

-

Use the following financial information for Samsung. Required 1. Compute book value per share for Samsung. 2. Compute earnings per share (EPS) for Samsung. 3. If Samsung buys back outstanding shares...

-

a. When a monopoly is maximizing its profits, price is greater than marginal cost. b. For a monopoly producing a certain amount of output, price is less than marginal revenue. c. When a monopoly is...

-

Coronado Corporation accumulates the following data relative to jobs started and finished during the month of June 2025. Costs and Production Data Actual Standard Raw materials unit cost $2.20 $2.10...

-

Consider the following labor statistics for the adult population (age 16 and older) in Norway displayed in the table below (all numbers in millions). Employed 110 13 Not in Labor Force 75 Unemployed...

-

Blossom Variety Store uses the LIFO retail inventory method. Information relating to the computation of the inventory at December 31, 2026, follows: Cost Retail Inventory, January 1, 2026 $147,000...

-

Use polynomial division to show that the general expression for the factors of the difference of two cubes, x 3 - y 3 = ( x - y ) ( x 2 + xy + y 2 ) , is correct

-

A beam has a lenght of L = 9 m long and carrying the uniformly distributed load of w = 3 kN/m. w kN/m A RA a) Calculate the reaction at A. RA= KN L RB b) Calculate the maximum bending moment. Mmax=...

-

In Problem (A) Form the dual problem. (B) Find the solution to the original problem by applying the simplex method to the dual problem. Minimize C = 11x + 4x2 subject to 2x, + x, 2 8 -2x, + + 3x, 2 4...

-

DEPARTMENT DATA EMPLOYEE DATA EmployeeNumber FirstName Mary Rosalie Richard George Alan 3 4 5 7 8 9 855555ES 12 13 14 15 16 17 Create the database tables in SQL or ACCESS: 18 19 20 PROJECT DATA Ken...

-

Assume you are preparing for a class presentation on the accounting for factory overhead. Prepare a set of notes to guide a presentation that addresses the questions below. Required 1. Describe the...

-

A $100,000 initial investment will generate the following present values of net cash flows. What is the breakeven time for this investment? Present Value of Net Cumulative Present Value Year Cash...

-

A shoe manufacturer is evaluating new equipment that would custom fit athletic shoes. The new equipment costs $90,000 and will generate $35,000 in net cash flows for five years. Determine the...

-

Bought an old van for 4000 from Peters promising to pay laterwhat is the transactions

-

Company has a following trade credit policy 1/10 N45. If you can borrow from a bank at 9,5% annual rate, would it be beneficial to borrow money and pay off invoices earlier?

-

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable inter-market arbitrage opportunity? 129.87/$1.1226/$0.00864/ 114.96/ B $0.8908/ (C)...

Study smarter with the SolutionInn App