Compute the selling price of 10%, 15-year bonds with a par value of $240,000 and semiannual interest

Question:

Compute the selling price of 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments.

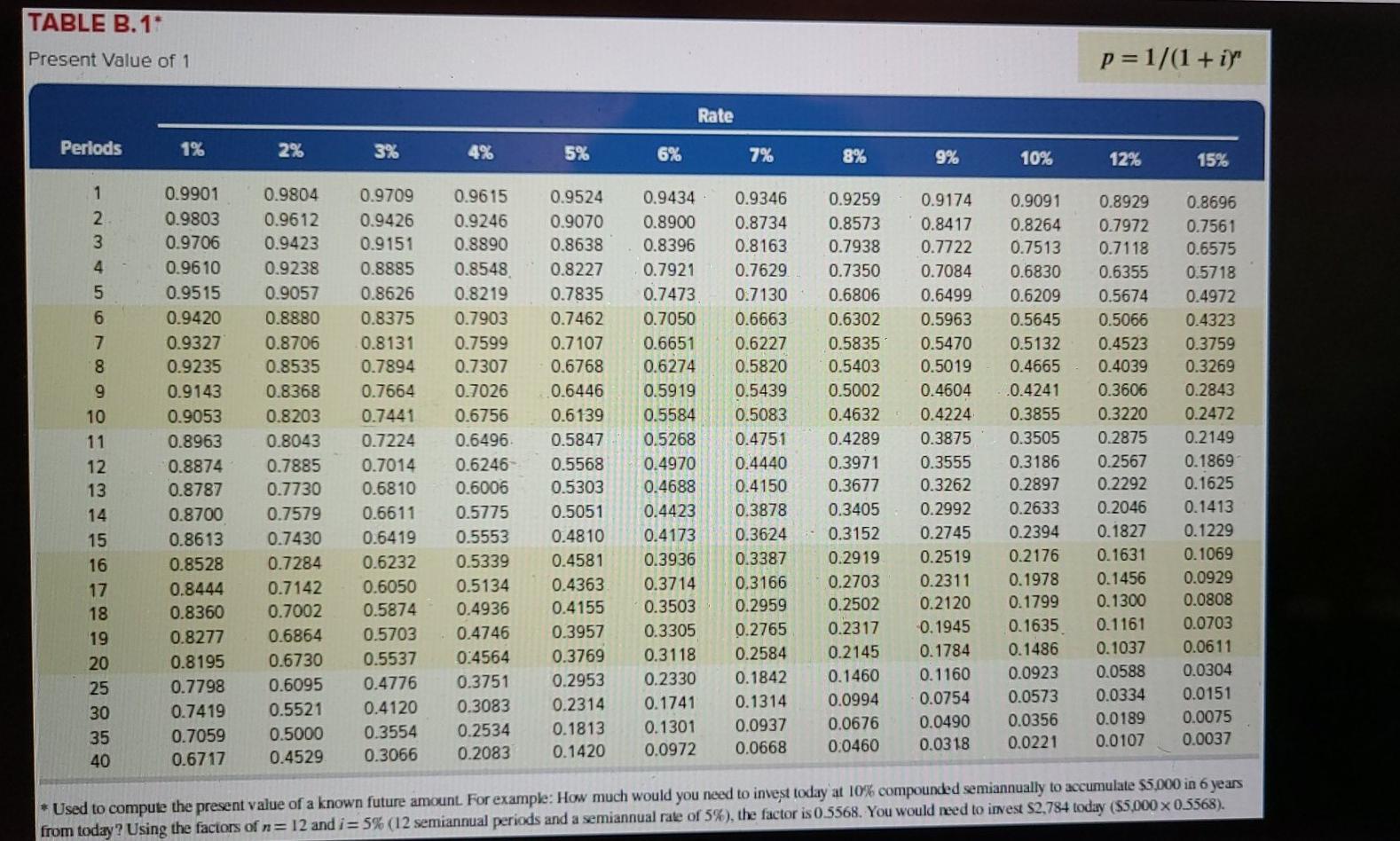

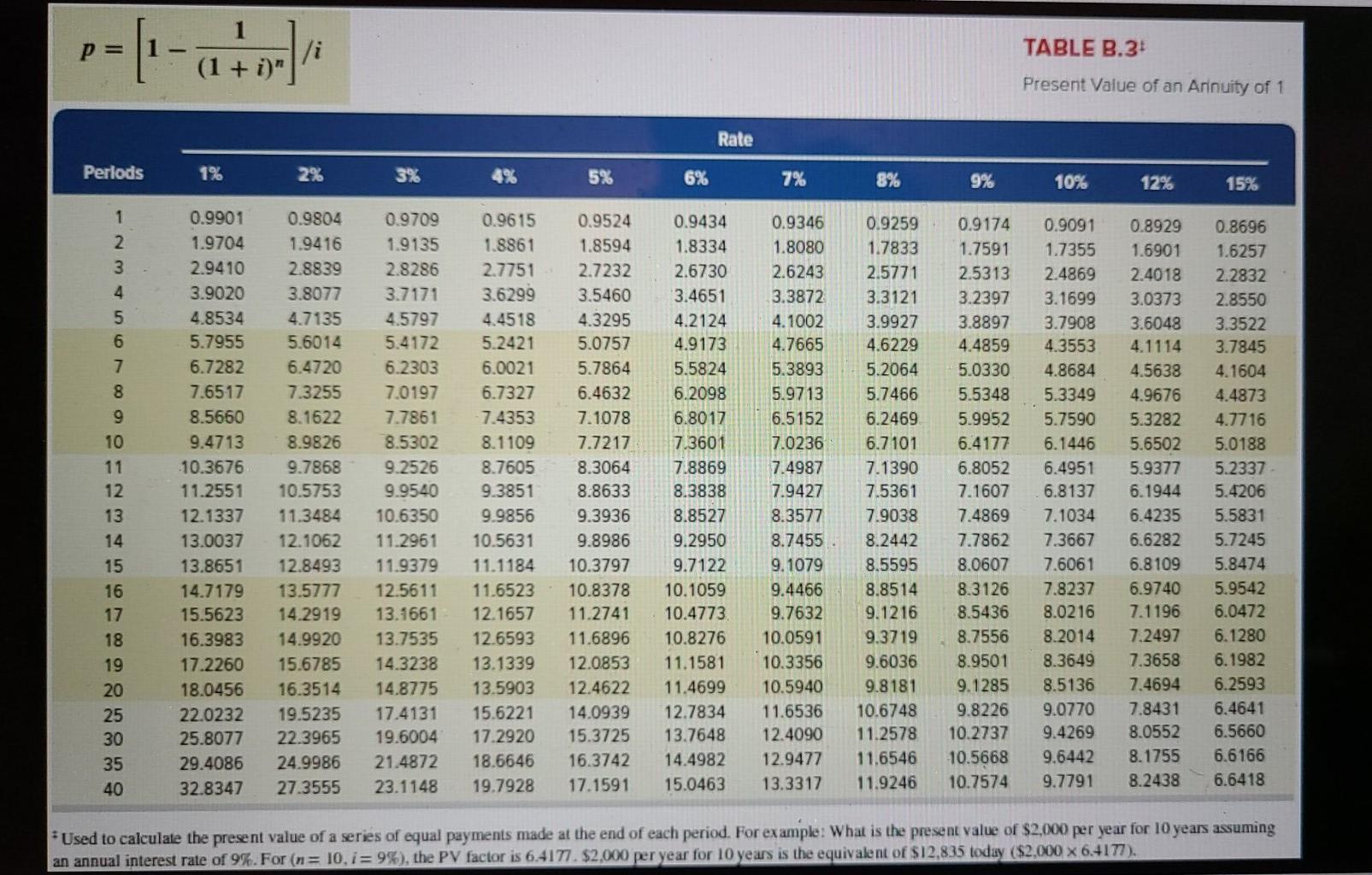

The annual market rate for these bonds is 8%. Use present value tables B.1 and B.3 in Appendix B.

Transcribed Image Text:

TABLE B.1 Present Value of 1 p=1/(1+i) Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.8929 0.8696 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.9091 0.8417 0.8264 0.7972 0.8900 0.7561 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8734 0.8163 0.7921 0.7629 0.8573 0.7938 0.7722 0.7118 0.6575 4 0.9610 0.9238 0.8885 0.8548 0.7513 0.6830 0.6355 0.8227 0.7835 0.5718 5 0.9515 0.9057 0.8219 0.7473 0.8626 0.8880 0.8375 0.7903 0.6209 0.5674 0.4972 0.7350 0.7084 0.6806 0.6499 0.6302 0.5963 0.5835 0.5470 0.7130 0.6663 6 0.9420 0.7462 0.7050 0.5645 0.5066 7 0.8706 0.4323 0.3759 0.8131 0.7599 0.7107 0.6651 0.6227 0.9327 0.9235 0.5132 0.4523 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4241 0.3606 0.2843 0.4604 0.4224 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.3855 0.3220 0.2472 0.9053 0.8963 0.8874 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.2875 0.2149 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2567 0.1869 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2292 0.1625 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2046 0.1413 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.1827 0.1229 16 0.8528 0.7284 0.5339 0.6232 0.4581 0.3936 0.3387 0.1069 0.2919 0.2519 0.2176 0.1631 0.8444 17 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.0929 0.2703 0.2311 0.1978 0.1456 18 0.8360 0.5874 0.4936 0.4155 0.7002 0.3503 0.2959 0.1300 0.2502 0.0808 0.2120 0.1799 0.0703 0.6864 19 0.4746 0.8277 0.5703 0.3957 0.1161 -0.1945 0.3305 0.1635 0.2317 0.2765 0.3769 0.8195 0:4564 0.1486 0.1037 0.1784 0.2584 0.3118 20 0.6730 0.5537 0.2145 0.0611 0.0304 0.0588 0.1460 0.0923 0.1160 25 0.7798 0.4776 0.3751 0.2330 0.1842 0.2953 0.6095 0.0573 0.0334 0.0151 0.0754 0.1314 0.5521 0.0994 0.3083 0.2314 0.7419 0.4120 0.1741 30 0.0189 0.0075 0.0490 0.0676 0.1301 0.1813 0.3554 0.2534 0.5000 0.0937 35 0.7059 0.0356 0.0318 0.0221 0.0107 0.0037 0:0460 0.0668 0.1420 0.2083 0.0972 0.4529 40 0.6717 0.3066 *Used to compute the present value of a known future amount. For example: How much would you need to invest today at 10% compounded semiannually to accumulate $5,000 in 6 years from today? Using the factors of n = 12 and i= 5% (12 semiannual periods and a semiannual rate of 5%), the factor is 0.5568. You would need to invest $2,784 today ($5,000 x 0.5568). 80 OH23 9 10 11 12 Rate

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Compute the selling price of 8%, 10-year bonds with a par value of $250,000 and semiannual interest payments. The annual market rate for these bonds is 10%. Use present value tables B.1 and B.3 in...

-

A European corporation has issued bonds with a par value of SFr 1,000 and an annual coupon of 5 percent. The last coupon on these bonds was paid four months ago, and their current clean price is 90...

-

A 10-year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,060. The bond sells for $1,100. (Assume that the bond has just been issued.) a. What is...

-

Consider a group of 12 employees of whom five are in management and seven do clerical work. Select at random a sample of size 4. What is the probability that there will be one manager in this sample?

-

A Biology student who created a regression model to use a bird's Height when perched for predicting its Wingspan made these two statements. Assuming the calculations were done correctly, explain what...

-

The surprising nature of Benford's law makes it a useful tool to detect fraud. When people make up numbers, they tend to make the first digits approximately uniformly distributed; in other words,...

-

1 How would your answers differ if the manager and subordinates were Swedish?

-

The intangible assets section of Redeker Company at December 31, 2010, is presented below. Patent ($70,000 cost less $7,000 amortization)..... $63,000 Franchise ($48,000 cost less $19,200...

-

Marwicks Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail customers for an average price of $2,600 each. The companys...

-

A ball of known charge q and unknown mass m, initially at rest, falls freely from a height h in a uniform electric field E that is directed vertically downward. The ball hits the ground at a speed v...

-

Ike issues $180,000 of 11%, three-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. They are issued at $184,566 when the market rate is 10%. Required 1....

-

National Motors Company advertised three alternatives for a 25-month lease on a new Tahoe: (1) Zero dollars down and a lease payment of $1,750 per month for 25 months, (2) $5,000 down and $1,500 per...

-

What interventions would allow the World Banks knowledge to be used strategically for the aid of clients in developing countries?

-

Aircraft \(B\) has a constant speed of \(150 \mathrm{~m} / \mathrm{s}\) as it passes the bottom of a circular loop of 400-m radius. Aircraft \(A\) flying horizontally in the plane of the loop passes...

-

A small inspection car with a mass of \(200 \mathrm{~kg}\) runs along the fixed overhead cable and is controlled by the attached cable at \(A\). Determine the acceleration of the car when the control...

-

An aircraft \(P\) takes off at \(A\) with a velocity \(v_{0}\) of \(250 \mathrm{~km} / \mathrm{h}\) and climbs in the vertical \(y^{\prime}-z^{\prime}\) plane at the constant \(15^{\circ}\) angle...

-

If each resistor in Figure P31.75 has resistance \(R=5.0 \Omega\), what is the equivalent resistance of the combination? Data from Figure P31.75 wwwwww wwwww www www wwwww

-

Identify the proper point to recognize expense for each of the following transactions. a. Kat Inc. purchases on credit six custom sofas for \(\$ 800\) each in June. Two of the sofas are sold for \(\$...

-

Youve collected data on the betas of various mutual funds. Each fund and its beta is listed below: Mutual Fund Beta Weak Fund....................0.23 Fido Fund......................0.77...

-

Quadrilateral EFGH is a kite. Find mG. E H <105 G 50 F

-

Identify the most likely role in an accounting system played by each of the numbered items 1 through 12 by assigning a letter from the list A through E on the left. A. Source documents B. Input...

-

Identify the most likely role in an accounting system played by each of the numbered items 1 through 12 by assigning a letter from the list A through E on the left. A. Source documents B. Input...

-

Enter the letter of each system principle in the blank next to its best description. A. Control principle B. Relevance principle C. Compatibility principle D. Flexibility principle E. Cost-benefit...

-

Green Lawn Company sells garden supplies. Management is planning its cash needs for the second quarter. The following information has been assembled to assist in preparing a cash budget for the...

-

eBook Question Content Area Comparison of Methods of Allocation Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory...

-

TYBALT CONSTRUCTION Income Statement For Year Ended December 31 TYBALT CONSTRUCTION Income Statement For Year Ended December 31

Study smarter with the SolutionInn App