Mainland Resources Inc. began operations on June 5, 2017. Journalize the following equity transactions that occurred during

Question:

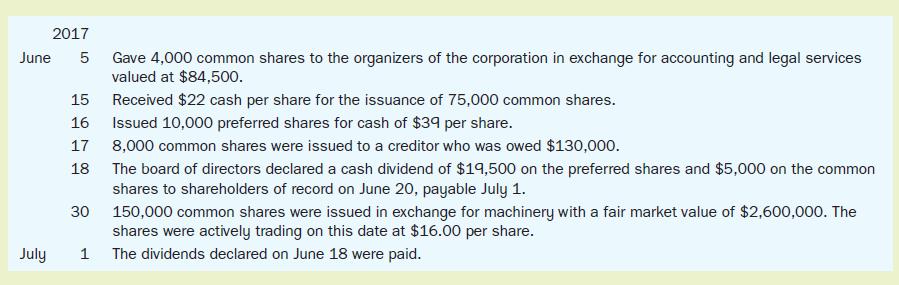

Mainland Resources Inc. began operations on June 5, 2017. Journalize the following equity transactions that occurred during the first month of operations:

Transcribed Image Text:

June July 2017 5 15 16 17 18 30 1 Gave 4,000 common shares to the organizers of the corporation in exchange for accounting and legal services valued at $84,500. Received $22 cash per share for the issuance of 75,000 common shares. Issued 10,000 preferred shares for cash of $39 per share. 8,000 common shares were issued to a creditor who was owed $130,000. mon The board of directors declared a cash dividend of $19,500 on the preferred shares and $5,000 on the comm shares to shareholders of record on June 20, payable July 1. 150,000 common shares were issued in exchange for machinery with a fair market value of $2,600,000. The shares were actively trading on this date at $16.00 per share The dividends declared on June 18 were paid.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 37% (8 reviews)

2017 June 5 Organization Expenses or other various expenses Common Shares Issue...View the full answer

Answered By

Ayush Jain

Subjects in which i am expert:

Computer Science :All subjects (Eg. Networking,Database ,Operating System,Information Security,)

Programming : C. C++, Python, Java, Machine Learning,Php

Android App Development, Xamarin, VS app development

Essay Writing

Research Paper

History, Management Subjects

Mathematics :Till Graduate Level

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781259087363

15th Canadian Edition

Authors: Kermit Larson, Heidi Dieckmann

Question Posted:

Students also viewed these Business questions

-

Mainland Resources Inc. began operations on June 5, 2014. Journalize the following equity transactions that occurred during the first month ofoperations: 2014 5 Gave 4,000 common shares to the...

-

Mainland Resources Inc. began operations on June 5, 2020. Journalize the following equity transactions that occurred during the first month of operations: 2020 Gave 4,000 common shares to the...

-

On December 2017, A group of five friends decided to open ABC Company, which dealt with providing renewable energy solutions and consultancy services to houses and commercial buildings among some....

-

Five separate projects have calculated rates of return of 8, 11, 12.4, 14, and 19% per year. An engineer wants to know which projects to accept on the basis of rate of return. She learns from the...

-

In order to function effectively, the internal auditor must often educate auditees and other par ties about the nature and purpose of internal auditing. a. Define internal auditing. b. Briefly...

-

The following transactions apply to Tractor Sales for 2013: 1. The business was started when the company received $60,000 from the issue of common stock. 2. Purchased equipment inventory of $325,000...

-

3.9

-

The administrators of Tiny College are so pleased with your design and implementation of their student registration/tracking system that they want you to expand the design to include the database for...

-

Jonathan and Emily Berry grew up watching their grandmother make the best chocolates at Christmas using an old family recipe. They had a vision that they could mass-market these chocolates, expecting...

-

Curtis Ltd. issued $100,000 of 8% bonds at face value on October 1, 2017. Interest is paid each March 31 and September 30. If Curtiss tax rate is 40%, what is the annual after-tax borrowing cost (a)...

-

On January 1, 2017, British Software Ltd. issued $450,000 of 20-year, 8% bonds that pay interest semiannually on June 30 and December 31. The bonds were sold to investors at their par value. a. How...

-

Market price may not reach equilibrium if there are ______. a) both price ceilings and price floors b) neither price ceilings nor price floors c) only price ceilings d) only price fl oors

-

Given the following differential equation, dydx = sin ( x + y ) Find the following: ( a ) The substitution u = ( b ) The transformed differential equation dudx = ( c ) The implicit solution, given...

-

Consider the following type declarations TYPE Alinteger; A2 pointer to float; A3 pointer to integer; T1 structure (x: integer; } T2 structure (x: A1; next pointer to integer; } b float; } a :...

-

https://www.viddler.com/embed/82b62f65 Questions: How do companies decide where to locate their facilities? Why has just-in-time inventory control become a dominant production process used in the...

-

Adjusting Entries for Interest At December 31 of Year 1, Portland Corporation had two notes payable outstanding (notes 1 and 2). At December 31 of Year 2, Portland also had two notes payable...

-

We want to get an idea of the actual mass of 235U involved in powering a nuclear power plant. Assume that a single fission event releases 200 MeV of thermal energy. A 1,000 MWe electric power plant...

-

A local library receives a bequest of $100,000 from a prominent local family. How much will this provide at the beginning of each 3-month period for the next 212 years if money is worth 7.4%...

-

If there is an unrealized holding gain on available-for-sale investments, it is reported as?

-

Lisa Montgomery and Joel Chalmers established a coffee bean distribution business. Their partnership shared profits and losses based on an agreement that gave Lisa a salary allowance of $45,000 and...

-

On April 1, 2022, Guy Comeau and Amelie Lavoi formed a partnership in Ontario. Net Income during the year was $560,000 and was in the Income Summary account.On April 1, 2023 Travis Roberts invested...

-

Bill Ace and Dennis Bud are partners in an urban restaurant called Salt. Profit for the year ended March 31, 2023, is $120,000. a. How much profit should be allocated to each partner assuming there...

-

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report....

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

Study smarter with the SolutionInn App