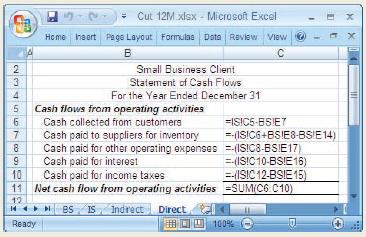

Refer to the information presented in S12-7. Required: Complete the same requirements, except use the direct method

Question:

Refer to the information presented in S12-7.

Required:

Complete the same requirements, except use the direct method only.

Data From S12-7:

You’ve recently been hired by B2B Consultants to provide financial advisory services to small business managers. B2B’s clients often need advice on how to improve their operating cash flows and, given your accounting background, you’re frequently called upon to show them how operating cash flows would change if they were to speed up their sales of inventory and their collections of accounts receivable or delay their payment of accounts payable. Each time you’re asked to show the effects of these business decisions on the cash flows from operating activities, you get the uneasy feeling that you might inadvertently miscalculate their effects. To deal with this once and for all, you e-mail your friend Owen and ask him to prepare a template that automatically calculates the net operating cash flows from a simple comparative balance sheet. You received his reply today.

From: Owentheaccountant@yahoo.com

To: Helpme@hotmail.com

Cc:

Subject: Excel Help

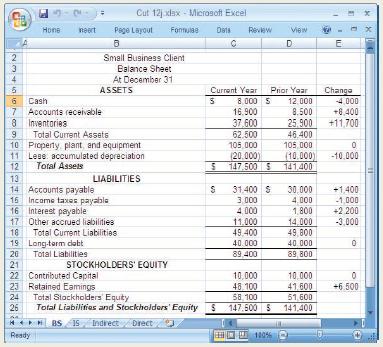

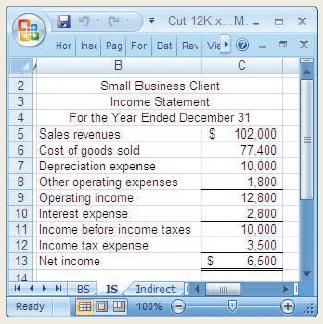

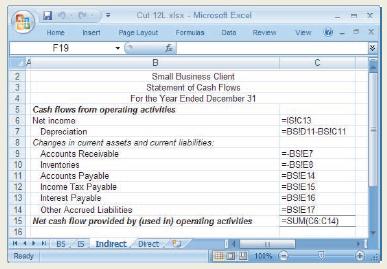

Hey pal. I like your idea of working smarter, not harder. Too bad it involved me doing the thinking. Anyhow, I’ve created a spreadsheet file that contains four worksheets. The first two tabs (labeled BS and IS) are the input sheets where you would enter the numbers from each client’s comparative balance sheets and income statement. Your clients are small, so this template allows for only the usual accounts. Also, I’ve assumed that depreciation is the only reason for a change in accumulated depreciation. If your clients’ business activities differ from these, you’ll need to contact me for more complex templates. The third worksheet calculates the operating cash flows using the indirect method and the fourth does this calculation using the direct method. I’ll attach the screenshots of each of the worksheets so you can create your own. To answer “what if” questions, all you’ll need to do is change selected amounts in the balance sheet and income statement.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby